Introduction

Waters of Loan Services in the USA: A BBB Guide In the vast and complex landscape of financial services, obtaining a loan is a significant milestone for many individuals and businesses in the United States. With the plethora of options available, it becomes crucial to discern reliable and reputable loan services. One valuable resource in this pursuit is the Better Business Bureau (BBB), an organization that plays a pivotal role in assessing and accrediting businesses. In this article, we will delve into the world of loan services in the USA, with a specific focus on the importance of the BBB in ensuring a safe and trustworthy borrowing experience.

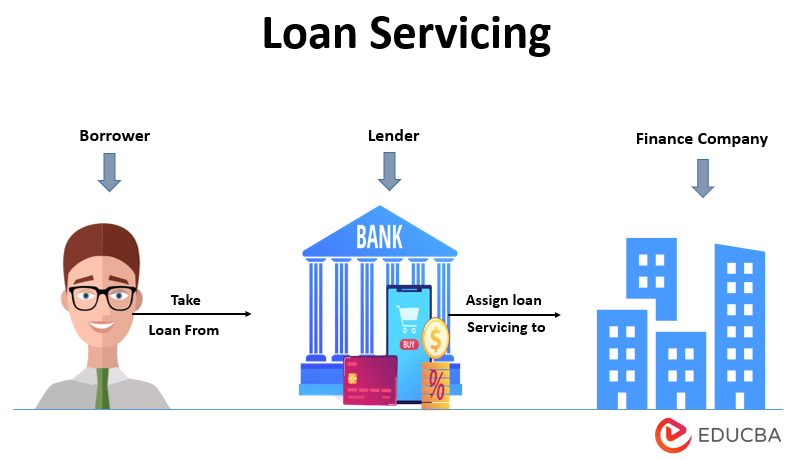

Understanding the Loan Services Landscape in the USA

The United States boasts a diverse array of loan services catering to various needs, including personal loans, mortgages, auto loans, and small business loans. As the demand for financial assistance continues to rise, the market has witnessed the emergence of numerous lenders, ranging from traditional banks to online platforms and credit unions.

The Role of the Better Business Bureau (BBB)

The Better Business Bureau, founded in 1912, is a nonprofit organization focused on fostering an ethical marketplace by evaluating and accrediting businesses based on their performance and customer satisfaction. The BBB assigns ratings to businesses, ranging from A+ to F, with A+ being the highest and F the lowest.

Key Factors Evaluated by the BBB

- Customer Complaints and Resolution The BBB tracks and analyses customer complaints lodged against businesses, including loan services. A lender’s ability to address and resolve these complaints is a significant factor in determining its BBB rating. Companies with a history of prompt and satisfactory complaint resolution are likely to receive higher ratings.

- Transparency and Ethical Practices Transparency is crucial in the financial industry. The BBB evaluates how openly a loan service provider communicates terms, conditions, and fees to its customers. Ethical practices, such as honest advertising and fair lending policies, contribute positively to a lender’s BBB rating.

The Importance of BBB Accreditation for Loan Services

Loan service providers that seek and maintain BBB accreditation demonstrate a commitment to ethical business practices and customer satisfaction.

Steps to Utilize the BBB in Evaluating Loan Services

- Visit the BBB Website Start by visiting the official Better Business Bureau website (www.bbb.org). The website is user-friendly and allows users to search for businesses, including loan service providers, by name, location, or industry.

- Check the BBB Rating Once you locate the loan service provider, review its BBB rating. The rating provides a quick overview of the business’s overall performance and reputation. Pay attention to the rating factors, including the number of customer complaints and the resolution status.

Conclusion

In the vast and sometimes overwhelming landscape of loan services in the USA, the Better Business Bureau stands as a reliable ally for borrowers. By leveraging the BBB’s ratings and reviews, individuals and businesses can make informed decisions,

One Comment on “Waters of Loan Services in the USA: A BBB Guide”