Introductio

In the vibrant and competitive landscape of the United States, access to financial resources is paramount for businesses looking to thrive and expand. One significant avenue for securing the necessary capital is through business loans. This comprehensive guide will delve into the intricacies of obtaining a business loan in the USA, exploring the types of loans available, the application process, and essential tips for successful loan management.

Types of Business Loans

Before embarking on the journey of acquiring a business loan, it’s crucial to understand the various types available, each tailored to meet specific business needs. Here are some common types of business loans in the USA:

- SBA Loans: Backed by the Small Business Administration, these loans offer favorable terms and are designed to support small businesses. They include the 7(a) loan program, CDC/504 loan program, and microloans.

- Term Loans: A traditional form of business financing, term loans provide a lump sum of capital that is repaid over a fixed term with a set interest rate.

- Business Lines of Credit: A revolving credit option that allows businesses to draw funds up to a predetermined limit. Interest is only paid on the amount borrowed.

- Equipment Loans: Specifically for the purchase of equipment, this type of loan allows businesses to acquire necessary machinery or technology without compromising cash flow.

- Commercial Real Estate Loans: Tailored for businesses looking to purchase or renovate commercial properties, these loans use the property as collateral.

- Invoice Financing: Ideal for businesses with outstanding invoices, this financing option involves receiving a percentage of the invoice amount upfront, with the remainder paid once the customer settles the invoice.

Assessing Your Business Needs

Before diving into the loan application process, it’s crucial to assess your business needs and determine the type of financing that aligns with your goals. Consider the following questions:

- Why do you need the loan?

- How much capital do you require?

- What is the purpose of the funds (e.g., expansion, equipment purchase, working capital)?

- What is your business’s current financial health?

Understanding these factors will guide you in selecting the most appropriate type of loan for your business.

The Business Loan Application Process

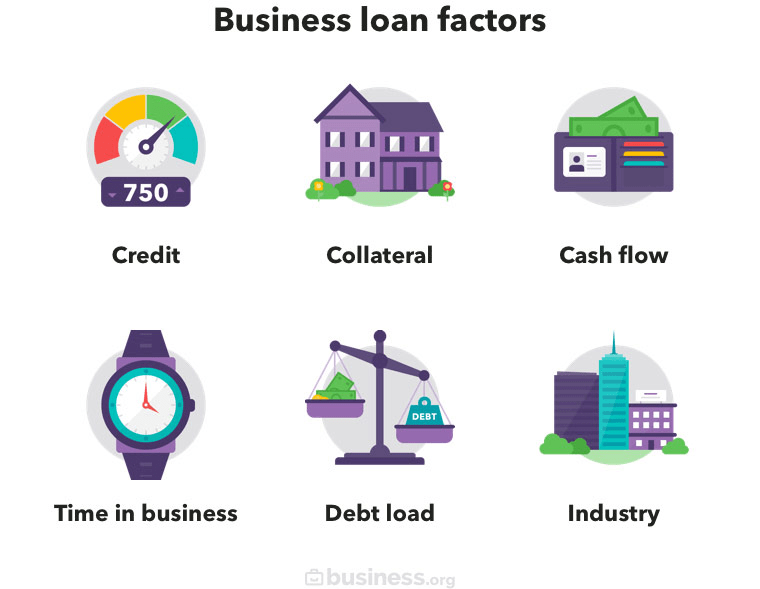

1. Evaluate Your Eligibility:

Before applying for a business loan, assess your eligibility by reviewing the lender’s requirements. This often includes factors such as credit score, time in business, annual revenue, and industry.

2. Prepare Financial Documentation:

Lenders typically require a comprehensive set of financial documents, including business tax returns, profit and loss statements, balance sheets, and bank statements. Having these prepared in advance streamlines the application process.

3. Create a Detailed Business Plan:

A well-crafted business plan provides lenders with insights into your business’s goals, strategies, and financial projections. It serves as a roadmap, showcasing how the loan will contribute to your business’s success.

4. Determine Loan Amount and Terms:

Clearly define the loan amount you need and the repayment terms that align with your business’s cash flow. Be realistic about your ability to repay the loan while sustaining business operations.

5. Explore Lending Options:

Research and compare various lenders, including traditional banks, credit unions, online lenders, and alternative financing sources. Each may offer different terms, interest rates, and eligibility criteria.

6. Submit the Loan Application:

Complete the loan application provided by the chosen lender. Be thorough and accurate in providing all required information and documentation.

7. Underwriting and Approval:

The lender will conduct a thorough review of your application, financial documents, and credit history. If your application meets their criteria, you’ll receive an approval with specified loan terms.

8. Closing and Funding:

Once approved, the closing process involves signing the loan agreement and any additional documents. After closing, the funds will be disbursed to your business account.

Tips for Successful Business Loan Management

Acquiring a business loan is just the beginning; responsible and strategic management is essential for long-term success. Consider the following tips:

- Budget Wisely: Integrate loan repayments into your budget to ensure timely payments and avoid financial strain.

- Monitor Cash Flow: Keep a close eye on your business’s cash flow to ensure you can meet loan obligations while covering day-to-day operational expenses.

- Communicate with Lenders: If faced with challenges, communicate proactively with your lender. Some may offer flexibility or alternative arrangements during difficult times.

- Invest in Growth: Use the loan strategically to invest in areas that contribute to the growth and profitability of your business.

- Regularly Review Loan Terms: Periodically review the terms of your business loan. If you’ve experienced positive changes in your business, consider refinancing for better terms.

Conclusion

Navigating the path to securing a business loan in the USA requires careful consideration, strategic planning, and effective management. By understanding the types of loans available, thoroughly preparing for the application process, and implementing responsible financial practices post-loan acquisition, businesses can leverage these financial tools to drive growth and success. Remember, a well-managed business loan is not just a financial boost but a strategic asset for the sustainable development of your business.

3 Comments on “Unlocking Growth A Comprehensive Guide to Business Loans”