Introduction

In today’s fast-paced world, education plays a pivotal role in shaping individuals’ futures. Pursuing higher education in the United States, renowned for its top-notch universities and diverse academic programs, is a dream for many. However, the cost associated with education can be a significant barrier for aspiring students. In this context, non-collateral education loans have emerged as a lifeline, offering financial support without the need for tangible assets as security. This article explores the nuances of non-collateral education loans for students in the USA, shedding light on their benefits, application process, and considerations.

Understanding Non-Collateral Education Loans

Non-collateral education loans are financial instruments designed to provide students with the necessary funds to pursue higher education without requiring any physical assets as collateral. Unlike traditional loans that may demand tangible security, such as property or vehicles, non-collateral education loans focus on the borrower’s potential and academic aspirations. These loans are specifically tailored to meet the unique financial needs of students, allowing them to concentrate on their studies without the added burden of collateral.

Benefits of Non-Collateral Education Loans

- Accessibility: Non-collateral education loans enhance accessibility to education by removing the barrier of requiring substantial assets as collateral. This ensures that a broader spectrum of students, regardless of their financial background, can pursue their academic goals.

- Flexible Repayment Options: These loans often come with flexible repayment options, taking into consideration the uncertainties that students may face after completing their education. Some lenders offer grace periods, allowing borrowers to find stable employment before initiating repayments.

- Competitive Interest Rates: Non-collateral education loans typically offer competitive interest rates, making them more affordable for students. This ensures that the financial burden of repayment is manageable, even for those who might be entering the job market.

- No Impact on Credit History: As these loans do not require collateral, they do not impact the borrower’s credit history in the same way that secured loans might. This is beneficial for students who are building their credit profile for the first time.

Application Process for Non-Collateral Education Loans

- Research Lenders: Begin by researching various lenders that offer non-collateral education loans. Consider factors such as interest rates, repayment terms, and eligibility criteria.

- Gather Documentation: Prepare the necessary documentation, including proof of enrollment, academic records, and details of the educational institution. Lenders may also require information about your intended course of study and estimated expenses.

- Submit Application: Complete the application process by submitting the required documents and filling out the loan application. Be thorough and accurate to increase the chances of approval.

- Approval and Disbursement: Upon approval, the lender will disburse the loan amount directly to the educational institution to cover tuition, fees, and other related expenses.

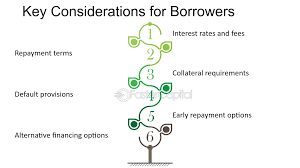

Considerations for Borrowers

- Loan Terms and Conditions: Examine the loan’s terms and conditions, paying particular attention to the interest rates, payback schedules, and any other costs. Understand the implications of the loan agreement before committing.

- Budgeting: Create a comprehensive budget outlining your educational expenses and anticipated income post-graduation. This will help you manage your finances effectively and plan for loan repayments.

- Explore Grants and Scholarships: While non-collateral education loans are a valuable resource, explore other avenues for financial aid, such as grants and scholarships, to reduce the overall financial burden.

- Build a Strong Credit Profile: Although non-collateral education loans may not heavily rely on credit history, maintaining a positive credit profile is essential for future financial endeavors. Make timely repayments to build a strong credit history.

Conclusion

Non-collateral education loans have emerged as a vital tool in empowering students to pursue higher education in the USA without the constraints of collateral. These loans not only enhance accessibility but also provide flexibility and competitive interest rates. Aspiring students should carefully navigate the application process, considering the terms and conditions, and exploring additional financial aid options. With the right financial support, students can focus on their studies, paving the way for a brighter and more promising future.

2 Comments on “Understanding Non Collateral Education Loans in the USA”