Insurance policies play a pivotal role in safeguarding individuals, businesses, and assets against unforeseen risks and uncertainties. In Austria, a country known for its commitment to social welfare and comprehensive healthcare, the insurance landscape reflects a diverse array of policies designed to meet the varied needs of its residents. In this comprehensive guide, we will navigate through the intricacies of insurance policies in Austria, exploring the different types available, the regulatory framework governing them, and the key considerations for individuals and businesses seeking comprehensive coverage.

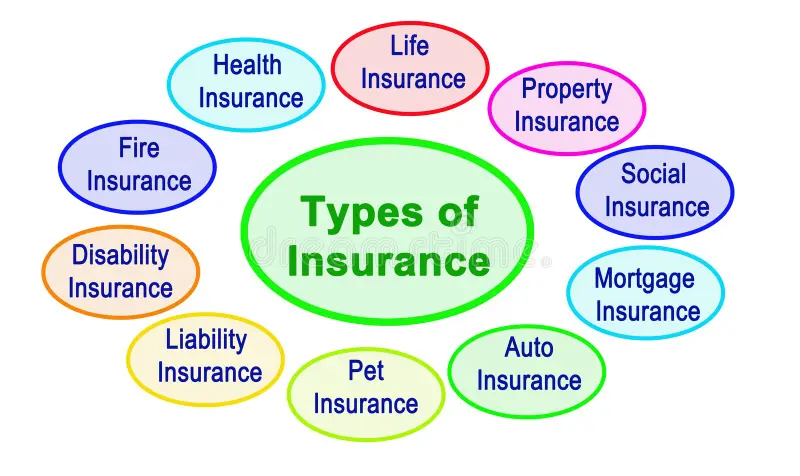

Types of Insurance Policies in Austria

1. Health Insurance:

Health insurance is a cornerstone of the Austrian insurance system, reflecting the nation’s commitment to universal healthcare. Social health insurance, mandatory for all residents, covers a broad spectrum of medical services, including doctor visits, hospital stays, medications, and preventive care. Private health insurance can also be obtained to supplement coverage and access additional benefits.

2. Motor Vehicle Insurance:

Motor vehicle insurance, including liability and comprehensive coverage, is mandatory for all drivers in Austria. Liability insurance covers damages to third parties, while comprehensive coverage extends protection to the insured vehicle. The competitive insurance market in Austria provides drivers with options to tailor coverage based on their needs and preferences.

3. Property Insurance:

Property insurance protects against damages to homes, buildings, and belongings. Homeowners can secure coverage for risks such as fire, natural disasters, theft, and liability. Renters can opt for renters’ insurance to protect their personal belongings within a rented property. Property insurance is essential for mitigating financial risks associated with unexpected events.

4. Life Insurance:

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. This type of insurance offers various options, including term life, whole life, and endowment policies. Life insurance serves as a crucial tool for long-term financial planning, providing peace of mind to policyholders and their loved ones.

5. Travel Insurance:

Travel insurance covers unforeseen events during domestic or international travel. This can include medical emergencies, trip cancellations, lost luggage, and other travel-related risks. Travel insurance policies vary, allowing travelers to choose coverage that aligns with their specific travel plans and potential risks.

6. Liability Insurance:

Liability insurance protects individuals and businesses from legal and financial consequences in case they are held responsible for causing harm to others. This can include personal liability for individuals and professional liability for businesses. Having liability insurance is a fundamental risk management strategy.

7. Business Insurance:

Business insurance encompasses a range of policies tailored to protect businesses from various risks. This includes property insurance for physical assets, liability insurance for legal and financial protection, and business interruption insurance to cover losses during disruptions. Tailoring business insurance to the specific needs of the enterprise is crucial for comprehensive coverage.

8. Cyber Insurance:

With the increasing prevalence of cyber threats, cyber insurance has become essential for businesses. This type of insurance protects against losses and liabilities arising from cyberattacks, data breaches, and other cyber-related incidents. Cyber insurance helps businesses recover from financial losses and reputational damage associated with cyber incidents.

Regulatory Framework and Oversight

1. Financial Market Authority (FMA):

The Financial Market Authority (FMA) in Austria serves as the regulatory body overseeing insurance companies and financial institutions. The FMA ensures compliance with legal and regulatory standards, monitors the financial stability of insurance companies, and protects the interests of policyholders. The authority plays a crucial role in maintaining the integrity of the insurance market.

2. Insurance Contract Act;

The Insurance Contract Act (VVG) establishes the legal framework for insurance contracts in Austria. It outlines the rights and obligations of both insurers and policyholders, sets forth the terms of insurance contracts, and governs the resolution of disputes. The VVG aims to create a fair and transparent environment for insurance transactions.

3. Supervision of Insurance Companies:

Insurance companies operating in Austria undergo strict supervision to ensure financial stability and compliance with regulatory standards. The FMA conducts regular assessments of insurers’ financial conditions, risk management practices, and adherence to legal requirements. This supervision is integral to maintaining the stability and reliability of the insurance sector.

Key Considerations for Policyholders

1. Coverage Adequacy:

Assessing the adequacy of coverage is crucial when selecting an insurance policy. Policyholders should carefully review the terms, conditions, and coverage limits to ensure that the policy meets their specific needs. For example, in health insurance, understanding the scope of coverage for medical treatments, hospital stays, and preventive care is essential.

2. Policy Exclusions and Limitations:

Insurance policies often contain exclusions and limitations that define situations or risks not covered by the policy. Policyholders should thoroughly understand these exclusions to avoid surprises in case of a claim. For instance, property insurance may have specific exclusions related to natural disasters or acts of war.

3. Premium Costs and Payment Terms:

Understanding the premium costs and payment terms is crucial for budgeting and financial planning. Policyholders should be aware of the premium amount, frequency of payments (monthly, annually, etc.), and any potential discounts or surcharges. In the case of life insurance, premium costs may vary based on factors such as age, health, and coverage amount.

4. Claims Process and Procedures:

Familiarity with the claims process and procedures is essential for a smooth experience in the event of a claim. Policyholders should be aware of the documentation required, the process for filing a claim, and the expected timeline for claim resolution. Prompt and accurate reporting of incidents is key to a seamless claims process.

5. Policy Renewal and Review:

Regularly reviewing insurance policies and assessing coverage adequacy is a best practice. Policyholders should be proactive in renewing policies on time and making necessary adjustments to coverage based on changing circumstances. For instance, in motor vehicle insurance, changes in driving habits or the acquisition of a new vehicle may warrant policy updates.

6. Comparing Policies and Providers:

Comparing insurance policies and providers allows policyholders to make informed choices based on coverage, costs, and reputation. The competitive insurance market in Austria offers individuals and businesses a range of options. Obtaining quotes from multiple insurers and understanding the nuances of each policy aids in making the best decision.

Emerging Trends in Insurance

1. Digitalization and Insurtech:

The insurance industry is witnessing a digital transformation, with the emergence of insurtech (insurance technology) solutions. Digital platforms and tools streamline the insurance process, from policy purchase to claims processing. Insurtech innovations enhance customer experiences and increase the efficiency of insurance operations.

2. Climate-Related Insurance:

With the increasing impact of climate change, there is a growing focus on climate-related insurance. This includes policies that address risks associated with extreme weather events, natural disasters, and other climate-related challenges. Insurers are adapting their offerings to provide coverage for climate-related risks.

I do agree with all the ideas you have introduced on your post They are very convincing and will definitely work Still the posts are very short for newbies May just you please prolong them a little from subsequent time Thank you for the post

It is very useful. บาคาร่าออนไลน์

I will continue to follow บาคาร่าออนไลน์

Your article helped me a lot, is there any more related content? Thanks!

qlBhQzXRa