taking out a loan is a big responsibility, and managing loan repayments can be challenging

Late payments can lead to additional fees and charges, damage your credit score, and even result in default. In this blog, we will explore some practical tips for managing your loan repayments and staying on top of your finances.

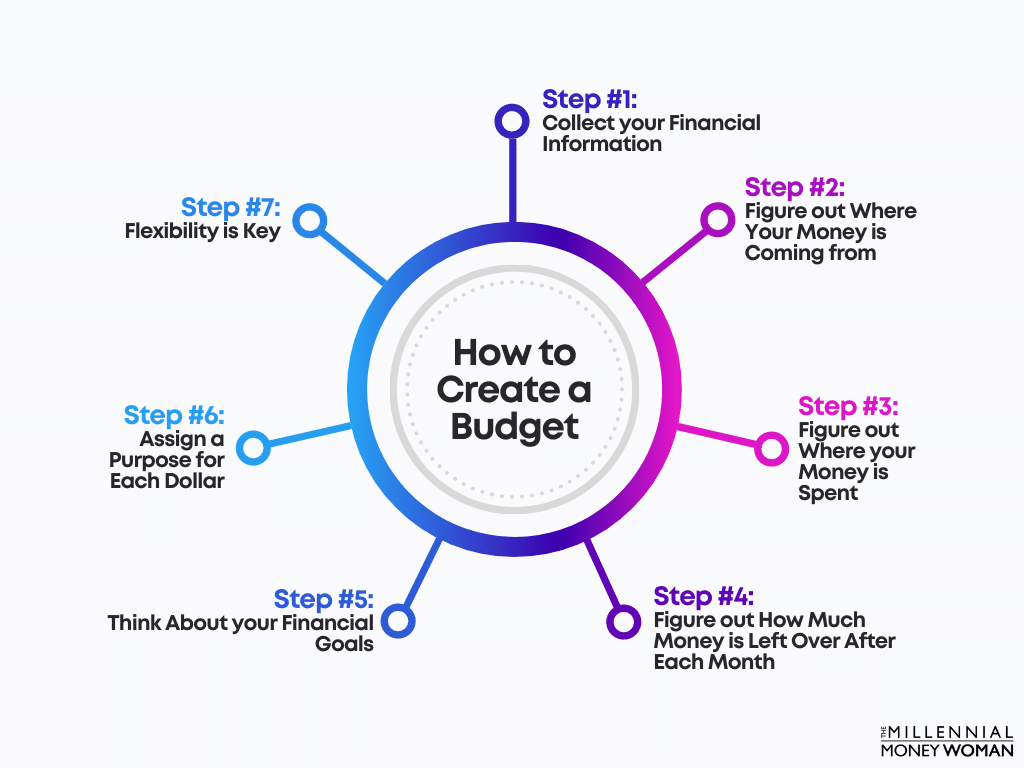

Create a budget:

The first step in managing your loan repayments is to create a budget. A budget helps you track your income and expenses and ensures that you have enough money to make your loan payments on time. Identify all your income sources and expenses and allocate a portion of your income towards your loan payments.

Set up automatic

payments: Automatic payments can make managing loan repayments much easier. Set up automatic payments through your bank or lender to ensure that your loan payments are made on time each month. This can also help you avoid late fees and penalties.

Pay more than the minimum payment:

If you have some extra money, consider paying more than the minimum payment on your loan. This can help you pay off your loan faster and reduce the total cost of borrowing. However, make sure that you’re not compromising other important financial goals such as saving for emergencies.

Communicate

with your lender: If you’re struggling to make your loan payments, communicate with your lender as soon as possible. They may be able to offer you a repayment plan or other options to help you manage your payments.

Prioritize your loan payments:

If you have multiple loans, prioritize your loan payments based on interest rates and repayment terms. Focus on paying off high-interest loans first, as they can be more expensive in the long run.

Avoid taking on new debt:

Taking on new debt while you’re still repaying a loan can be challenging. Avoid taking on new debt unless it’s absolutely necessary, and make sure that you can manage the additional payments.

Stay organized:

Keeping track of your loan statements, payment schedules, and other important documents can help you stay organized and avoid missing payments. Use a spreadsheet or a budgeting app to track your loan repayments and stay on top of your finances. In conclusion, managing loan repayments requires careful planning, organization, and communication with your lender. Create a budget, set up automatic payments, pay more than the minimum payment, communicate with your lender, prioritize your loan payments, avoid taking on new debt, and stay organized. By taking these steps, you can manage your loan repayments effectively and stay on top of your finances.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?