Introduction

The Role of Loan Websites in the USA In an era where financial needs often surpass available resources, many individuals turn to loans to bridge the gap. The advent of the internet has revolutionized the borrowing landscape, making it more accessible and convenient for people to secure financial assistance. This article delves into the world of loan websites in the USA, exploring their significance, functionalities, and how they have reshaped the way Americans approach borrowing.

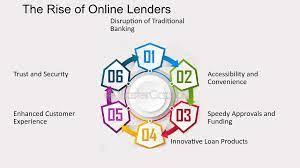

The Rise of Online Lending

Traditional lending institutions, such as banks and credit unions, have long been the primary sources of loans. However, the lengthy application processes, strict eligibility criteria, and extended approval timelines associated with these institutions led to a surge in demand for alternative lending options. This demand paved the way for the rise of online lending platforms.

The Functionality of Loan Websites

Loan websites serve as virtual marketplaces, connecting borrowers with a network of lenders willing to extend credit. These platforms typically offer various types of loans, including personal loans, payday loans, installment loans, and more. Users can explore different loan options, compare interest rates, and choose the terms that best align with their financial needs.

Key Features

One key feature of loan websites is their online application process. Borrowers can fill out a digital application form, providing necessary information such as personal details, income, and employment information. The online nature of these applications expedites the process, often resulting in quicker approval times compared to traditional lending institutions.

Advantages of Using Loan Websites

- Accessibility: One of the primary advantages of loan websites is their accessibility. Borrowers can access these platforms at any time, from anywhere with an internet connection. This is particularly beneficial for individuals who may face challenges visiting physical bank branches during regular business hours.

- Speed and Efficiency: Traditional loan applications often involve extensive paperwork and can take weeks to process. Loan websites expedite this process, providing a swift and efficient experience. Many borrowers appreciate the quick turnaround, especially in emergencies or situations requiring immediate financial assistance.

Challenges and Considerations

While loan websites offer numerous advantages, it’s crucial for borrowers to be aware of potential challenges and exercise caution. Some key considerations include:

- Interest Rates and Fees: Online loans may come with higher interest rates and fees compared to traditional loans. Borrowers should carefully review and understand the terms to avoid unexpected financial burdens.

- Scams and Fraudulent Practices: The online lending space has, at times, been associated with scams and fraudulent activities. Borrowers should thoroughly research and choose reputable loan websites to mitigate the risk of falling victim to such practices.

Conclusion

Loan websites in the USA have emerged as powerful tools, transforming the borrowing landscape and providing individuals with accessible and efficient financial solutions. While these platforms offer numerous benefits, it’s essential for borrowers to approach them with diligence, understanding the terms and conditions associated with each loan. With proper awareness and responsible financial practices, loan websites can continue to play a pivotal role in meeting the diverse borrowing needs of Americans in the digital age.

3 Comments on “The Role of Loan Websites in the USA”