Introduction:

Dental health is a vital aspect of overall well-being, yet many individuals neglect it due to the perceived high costs associated with dental care. Fortunately, dental insurance serves as a crucial tool in making dental treatments more accessible and affordable for individuals and families. In this comprehensive guide, we will explore the key aspects of dental insurance, including its importance, types of coverage, how to choose the right plan, and common misconceptions.

The Importance of Dental Insurance:

- Preventive Care: Dental insurance plays a pivotal role in promoting preventive care. Regular dental check-ups and cleanings are essential for maintaining good oral health and preventing more severe issues in the future. Dental insurance often covers these preventive services, encouraging individuals to seek timely care.

- Financial Protection: The cost of dental procedures, ranging from routine cleanings to complex surgeries, can be substantial. Dental insurance provides financial protection by covering a significant portion of these costs. This ensures that individuals can receive the necessary treatments without facing overwhelming financial burdens.

Types of Dental Insurance Coverage:

- Preventive Care: Most dental insurance plans cover preventive care, including routine check-ups, cleanings, and X-rays. These services are crucial for detecting and addressing dental issues in their early stages, saving both money and discomfort in the long run.

- Basic Procedures: Coverage for basic dental procedures such as fillings, extractions, and root canals is a standard feature in many dental insurance plans. These services address common dental problems and contribute to maintaining optimal oral health.

- Major Procedures: Some dental insurance plans also cover major procedures like crowns, bridges, and dentures. This coverage is essential for individuals requiring more extensive dental work, providing financial assistance for significant treatments.

- Orthodontic Coverage: Orthodontic treatments, including braces and aligners, are often not covered in standard dental insurance plans. However, some plans offer optional orthodontic coverage, catering to individuals seeking corrective procedures for misaligned teeth.

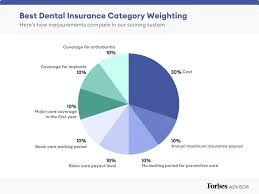

Choosing the Right Dental Insurance Plan:

- Coverage Options: When selecting a dental insurance plan, consider the coverage options available. Assess whether the plan covers preventive care, basic procedures, major treatments, and if orthodontic coverage is offered. Tailoring the plan to your specific needs ensures you receive comprehensive coverage.

- Network Providers: Dental insurance plans often have networks of dentists and specialists. Check whether your preferred dental professionals are within the plan’s network to maximize coverage. Some plans may allow you to visit out-of-network providers, but coverage may be reduced.

- Costs and Premiums: Evaluate the overall costs associated with the dental insurance plan, including monthly premiums, deductibles, and copayments. While lower premiums may seem attractive, it’s essential to consider the plan’s coverage and out-of-pocket costs to determine its true value.

- Waiting Periods: Be aware of any waiting periods imposed by the dental insurance plan. Some plans may have waiting periods for specific services, especially major procedures or orthodontic treatments. Understanding these waiting periods ensures you are prepared for potential delays in coverage.

Common Misconceptions About Dental Insurance:

- Dental Insurance is Expensive: While some individuals perceive dental insurance as costly, there are various affordable plans available. Comparing different options and understanding the coverage they offer can help find a plan that aligns with your budget.

- All Dental Insurance Plans Are the Same: Dental insurance plans vary in terms of coverage, costs, and network providers. Assuming that all plans are identical can lead to dissatisfaction and inadequate coverage. It’s crucial to carefully review and compare plans to find the one that best suits your needs.

- Dental Insurance Covers Cosmetic Procedures: Cosmetic procedures, such as teeth whitening, are generally not covered by dental insurance. Dental insurance focuses on preventive, basic, and major dental treatments aimed at maintaining or restoring oral health.

- Pre-existing Conditions Are Not Covered: Contrary to a common misconception, dental insurance often covers pre-existing conditions. However, waiting periods may apply before coverage kicks in for certain treatments. Understanding these waiting periods is essential for managing expectations.

Conclusion:

Dental insurance plays a crucial role in promoting oral health and making dental care accessible to a broader population. Understanding the importance of preventive care, the types of coverage available, and how to choose the right plan is essential for maximizing the benefits of dental insurance. By dispelling common misconceptions, individuals can make informed decisions that contribute to their overall well-being. Investing in a suitable dental insurance plan ensures that individuals and families can smile confidently, knowing their oral health is well-protected.

side effects of cialis

cialis black