Introduction:

In an era where technology continues to revolutionize various aspects of our lives, the financial industry is no exception. The advent of loan apps in the USA has transformed the traditional borrowing landscape, providing consumers with convenient and accessible solutions to meet their financial needs. This article explores the evolution of loan apps in the USA, examining their impact on borrowers and the broader financial ecosystem.

The Rise of Digital Lending:

Traditional lending processes often involve lengthy paperwork, extensive documentation, and time-consuming approval procedures. However, with the introduction of loan apps, borrowers can now access funds with unprecedented speed and efficiency. These apps leverage cutting-edge technology to streamline the application, approval, and disbursement processes, offering a hassle-free alternative to conventional lending.

User-Friendly Interfaces:

One of the key reasons for the widespread popularity of loan apps is their user-friendly interfaces. Designed to be intuitive and accessible, these apps cater to a diverse range of users, including those who may not be well-versed in financial jargon. Borrowers can navigate through the application process with ease, making the borrowing experience more inclusive and transparent.

Instant Approval and Disbursement:

Unlike traditional loan applications that may take days or even weeks for approval, loan apps in the USA provide borrowers with near-instantaneous decisions. The use of advanced algorithms and data analytics allows these apps to assess creditworthiness swiftly, expediting the approval process. Once approved, funds are often disbursed directly into the borrower’s account, offering unparalleled convenience during urgent financial situations.

Financial Inclusion:

Loan apps play a pivotal role in promoting financial inclusion by catering to individuals who may have limited access to traditional banking services. In the USA, where a significant portion of the population remains unbanked or underbanked, these apps bridge the gap by providing a viable avenue for obtaining credit. The simplified application processes and less stringent eligibility criteria make loans more accessible to a broader spectrum of borrowers.

Adapting to Changing Lifestyles:

The modern borrower’s lifestyle is fast-paced and dynamic, and loan apps have successfully adapted to these changing trends. Mobile applications allow users to apply for loans at any time, from anywhere, eliminating the need for physical visits to banks or financial institutions. This flexibility aligns with the demands of a tech-savvy generation that values convenience and efficiency in financial transactions.

Innovative Loan Products:

Loan apps in the USA are not limited to traditional personal loans. Many platforms offer innovative loan products tailored to specific needs, such as short-term payday loans, instalment loans, and cash advances.

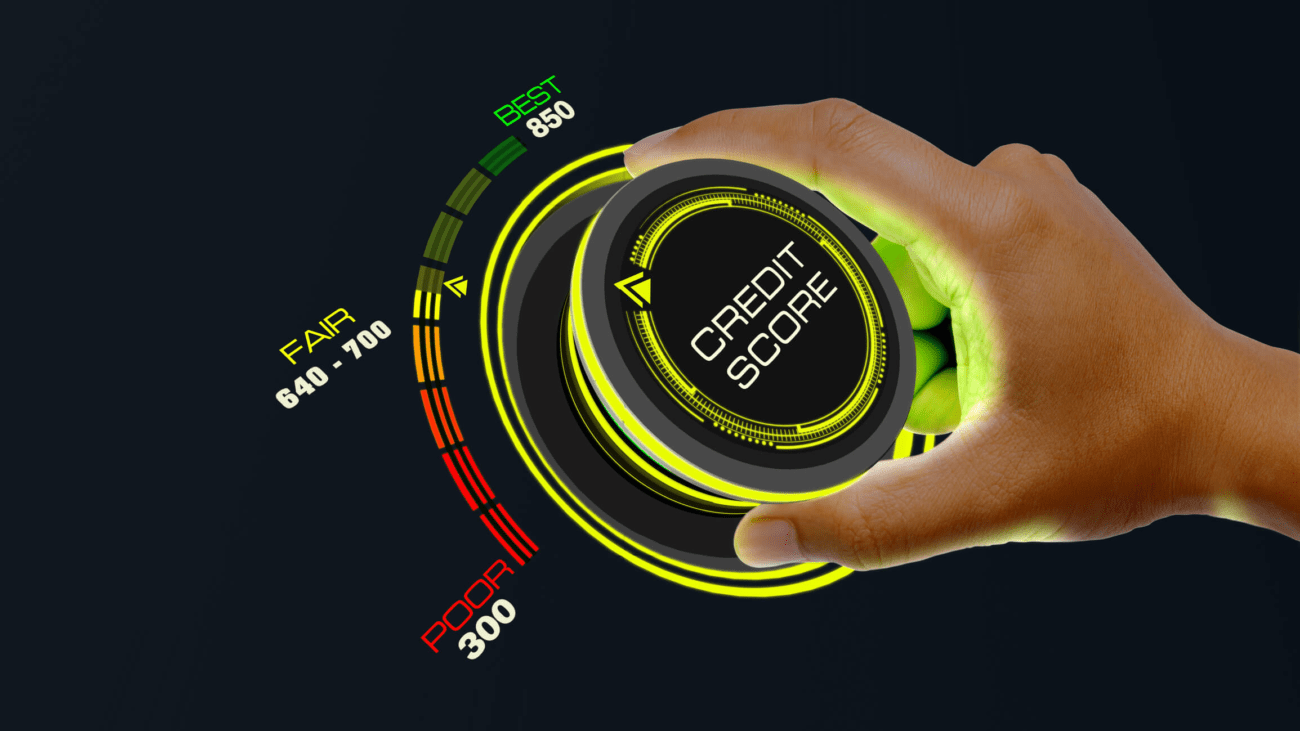

Credit Score Enhancement:

Some loan apps go beyond merely providing funds and actively contribute to the financial well-being of their users. By implementing features such as credit monitoring and financial education resources, these apps empower borrowers to enhance their credit scores over time. This, in turn, opens up opportunities for better interest rates and more favorable loan terms in the future.

Data Security and Privacy:

The digital nature of loan apps raises valid concerns about data security and privacy. Recognizing the importance of safeguarding sensitive information, reputable loan apps employ robust encryption measures and adhere to strict privacy policies.

Regulatory Landscape:

As the popularity of loan apps continues to grow, regulators are adapting to the evolving financial landscape. Various states in the USA have implemented or are considering regulations to govern digital lending platforms, ensuring fair practices, transparency, and consumer protection.

Conclusion:

The evolution of loan apps in the USA marks a significant shift in the way individuals access credit. From providing instant approvals and user-friendly interfaces to promoting financial inclusion and offering innovative loan products, these apps have redefined the borrowing experience. As the digital lending landscape continues to mature,