Introduction

Student Loan Forgiveness in the USA In the ever-evolving landscape of higher education costs, student loan debt has become a significant financial burden for millions of Americans. As borrowers grapple with the challenges of repayment, the concept of loan forgiveness has gained prominence as a potential relief mechanism. This article delves into the intricacies of loan forgiveness in the United States, exploring various programs, eligibility criteria, and the evolving policies that impact borrowers.

Understanding the Need for Loan Forgiveness

The United States is home to a staggering $1.7 trillion in student loan debt, affecting over 44 million borrowers. Loan forgiveness emerges as a crucial component of a multifaceted approach to addressing the student debt crisis.

Types of Loan Forgiveness Programs

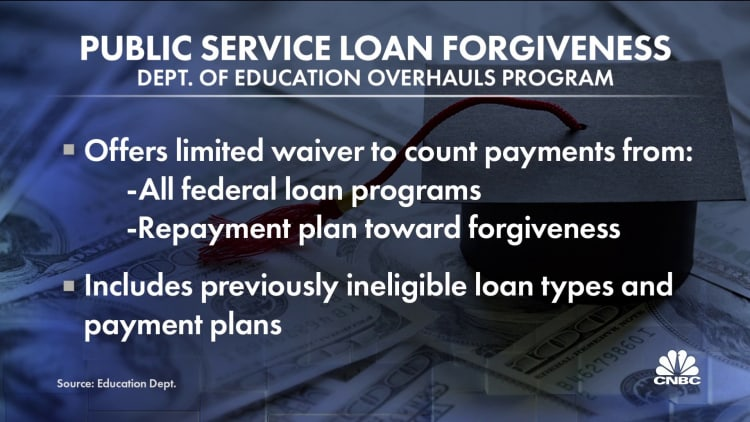

- Public Service Loan Forgiveness (PSLF): One of the most well-known forgiveness programs, PSLF is designed for individuals employed in qualifying public service jobs. Borrowers who make 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer may be eligible for forgiveness on the remaining balance.

- Teacher Loan Forgiveness: Targeting educators, this program offers forgiveness of up to $17,500 on federal student loans for teachers who work in low-income schools for five consecutive years. Eligibility criteria include teaching specific subjects and holding a relevant teaching certification.

Recent Developments in Loan Forgiveness Policies

Understanding the dynamics of student loan forgiveness requires staying informed about policy changes. In recent years, several notable developments have shaped the landscape:

- Biden Administration’s Loan Forgiveness Initiatives: However, the scope and mechanisms of these initiatives remain subject to ongoing debate and negotiation.

- Expansion of PSLF: Efforts have been made to expand and simplify the Public Service Loan Forgiveness program. Proposed changes include eliminating the 120-payment requirement and expanding eligibility to a broader range of federal student loans.

Navigating the Application Process

Applying for loan forgiveness involves a meticulous process, and understanding the specific requirements is crucial. Here are some general steps to guide borrowers:

- Evaluate Eligibility: Carefully review the eligibility criteria for the chosen forgiveness program.

- Choose the Right Repayment Plan: Selecting an appropriate repayment plan is essential, especially for income-driven forgiveness programs. Each plan has its own set of requirements, so borrowers must choose one aligned with their financial situation.

Challenges and Criticisms

While loan forgiveness programs aim to alleviate the burden of student debt, they are not without challenges and criticisms. Some common concerns include:

- Complexity and Red Tape: The application process for loan forgiveness can be complex and time-consuming. Many borrowers struggle with navigating the intricate requirements and may face challenges in accessing accurate information.

- Efforts to enhance education and outreach are crucial to ensuring that those in need can take advantage of available relief.

Conclusion

As student loan debt continues to be a pressing issue in the United States, the landscape of loan forgiveness programs remains dynamic. While existing initiatives provide relief to some borrowers, ongoing discussions about policy changes and broader forgiveness measures underscore the need for a comprehensive and sustainable solution.