Introduction

Owning a car in the United States can be a liberating experience, providing the freedom to travel at your own pace and convenience. However, for many, the prospect of purchasing a vehicle involves navigating the complex world of auto loans. In this comprehensive guide, we will walk you through the step-by-step process of applying for a USA auto loan, demystifying the intricacies and empowering you to make informed decisions on your journey towards securing the keys to your dream car.

Understanding Auto Loans in the USA

Before delving into the application process, it’s crucial to understand the fundamentals of auto loans in the USA. An auto loan is a financial arrangement where a lender provides funds to a borrower for the specific purpose of purchasing a vehicle. The borrower then repays the loan amount, typically with interest, over an agreed-upon period.

Auto loans come with various terms and conditions, including interest rates, loan duration, and down payment requirements. It’s essential to shop around and compare different loan offers to find the one that best aligns with your financial situation and preferences.

Step-by-Step Guide on How to Apply for a USA Auto Loan

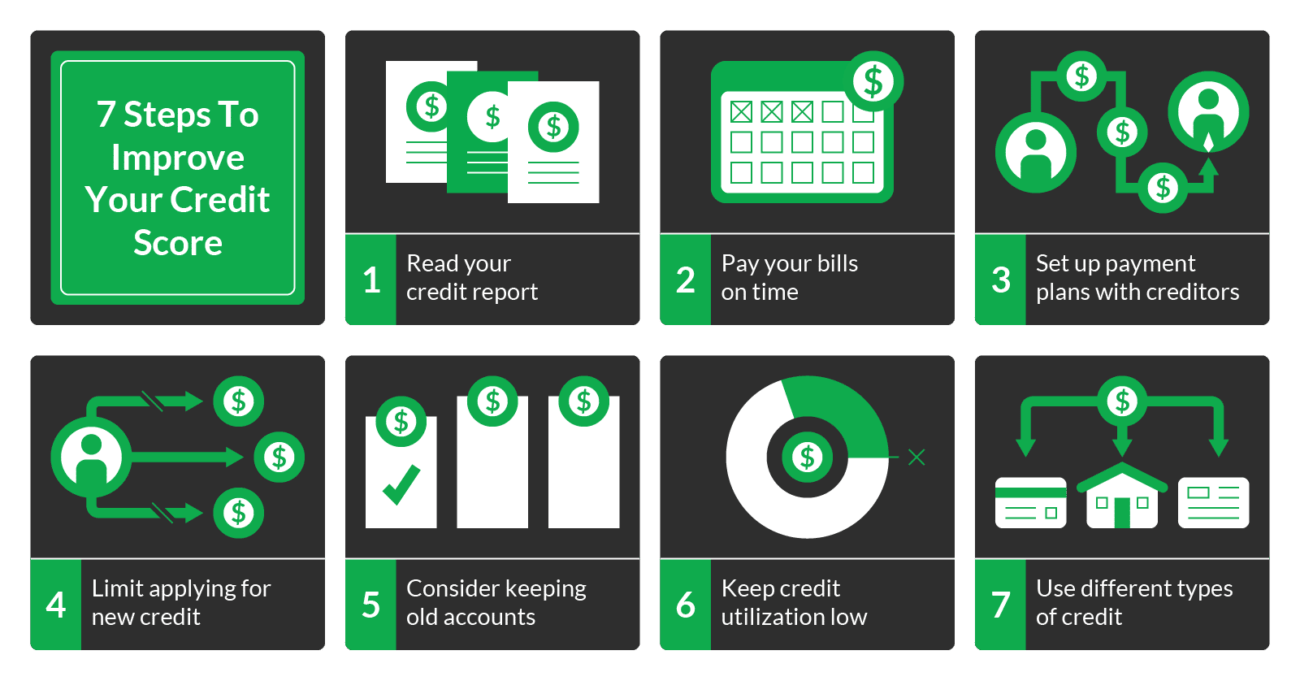

1. Check Your Credit Score

The interest rate you are eligible for is mostly determined by your credit score. Before applying for an auto loan, obtain a copy of your credit report and review your credit score. If your credit score isn’t the best, think about making some changes to it before applying for a loan.

2. Set a Budget

Determine how much you can afford to spend on a car by setting a realistic budget. Consider not only the purchase price but also factors like insurance, maintenance, and fuel costs. Setting a budget helps you narrow down your options and ensures that you choose a vehicle that fits comfortably within your financial means.

3. Research Lenders and Loan Options

Explore different lenders, including banks, credit unions, and online financial institutions, to find the best auto loan options. Compare interest rates, loan terms, and any additional fees associated with each lender. Online tools and calculators can be valuable resources for estimating monthly payments based on loan amount and interest rate.

4. Get Pre-Approved

Having your application for an auto loan pre-approved has many benefits. It gives you a clear understanding of how much you can borrow and the interest rate you qualify for, streamlining the car-buying process. Pre-approval also provides you with negotiating power when dealing with dealerships.

5. Choose the Right Vehicle

Once you have a pre-approved loan amount, start shopping for the right vehicle. Consider factors such as the make and model, new or used, and any additional features that align with your preferences. Keep in mind that your choice should fit within the budget established in step 2.

6. Finalize Loan Terms with the Lender

After selecting a vehicle, work closely with the lender to finalize the loan terms. This includes agreeing on the loan duration, interest rate, and any other conditions. Thoroughly review the terms before signing any documents, and ask the lender about any aspects that may be unclear.

7. Provide Necessary Documentation

Lenders will require certain documentation to process your auto loan application. Common documents include proof of identity, proof of income, proof of residence, and details about the vehicle you intend to purchase. Prepare these files in advance to speed up the application procedure.

8. Complete the Loan Application

Submit a complete and accurate loan application to the chosen lender. Be prepared to provide information about your financial history, employment status, and other relevant details. The lender will use this information to assess your creditworthiness and determine the terms of the loan.

9. Review Loan Agreement

Once your loan application is approved, carefully review the loan agreement before signing. Pay attention to the interest rate, monthly payments, and any additional fees. Seek clarification on any terms you find confusing or unclear. Only proceed if you are comfortable with the agreed-upon terms.

10. Take Delivery of Your Vehicle

After finalizing the loan agreement, you’re ready to take delivery of your vehicle. Ensure that all necessary paperwork, including the title and registration, is completed correctly. If purchasing from a dealership, they will typically handle these details. If buying from a private seller, you may need to coordinate these steps independently.

Tips for a Successful Auto Loan Application

- Look Around: Refuse to accept the first loan offer you are presented with. Explore multiple lenders to find the most favorable terms.

- Negotiate: Be prepared to negotiate not only the price of the vehicle but also the terms of the loan. A lower interest rate or extended loan term can significantly impact your overall costs.

- Understand the Total Cost: Consider the total cost of ownership, including insurance, maintenance, and potential fuel expenses, when determining your budget.

- Read the Fine Print: Thoroughly review all documents and agreements before signing. Be mindful of any hidden costs or penalties associated with early repayment.

- Be Mindful of Your Credit: Avoid applying for multiple loans simultaneously, as this can negatively impact your credit score. Instead, focus on getting pre-approved with a select few lenders.

Conclusion

Applying for a USA auto loan may initially seem like a daunting task, but with careful planning and a clear understanding of the process, it can be a straightforward and rewarding experience. By following this step-by-step guide, you’ll be better equipped to navigate the road to financial freedom and drive off in the car of your dreams. Remember to conduct thorough research, compare loan options, and make informed decisions to ensure a successful and satisfying auto loan application process.

6 Comments on “Financial Freedom on How to Apply for a USA Auto Loan”