Introduction:

In the ever-evolving landscape of personal finance, the concept of obtaining a personal loan with 0% interest has become an enticing prospect for many individuals. A personal loan with no interest is essentially a financial instrument that allows borrowers to access funds without incurring any interest charges during a specific period. This article delves into the intricacies of personal loans with 0% interest, exploring how they work, their advantages and disadvantages, and the key considerations for potential borrowers.

Understanding Personal Loans with 0% Interest:

A personal loan with 0% interest is not a mythical financial unicorn; it does exist, albeit with certain conditions. Typically, these loans are offered by financial institutions as promotional offers or incentives to attract new customers. The zero-interest feature is usually applicable for a limited period, ranging from a few months to a couple of years. During this promotional period, borrowers are not required to pay any interest on the principal amount borrowed.

The Mechanics Behind 0% Interest Loans:

Lenders offering personal loans with 0% interest often have specific terms and conditions that borrowers must meet to qualify for the promotional rate. These conditions may include a minimum credit score, a stable income, or other eligibility criteria. Additionally, the zero-interest period is finite, and borrowers need to be aware of the exact duration during which they won’t incur any interest charges.

Advantages of 0% Interest Personal Loans:

- Cost Savings: The most obvious advantage of a personal loan with 0% interest is the potential for significant cost savings. Without the burden of interest, borrowers can repay the principal amount without worrying about additional financial strain.

- Debt Consolidation: For individuals with multiple high-interest debts, a 0% interest personal loan can serve as an excellent tool for debt consolidation. By consolidating debts into a single loan with no interest, borrowers can streamline their repayment process and save money in the long run.

- Flexible Repayment Terms: In addition to zero interest, these loans often come with flexible repayment terms, allowing borrowers to tailor the repayment schedule to their financial situation. This flexibility can be particularly beneficial for those facing temporary financial challenges.

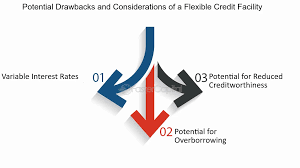

Considerations and Potential Drawbacks:

- Promotional Period Limitations: Borrowers must be vigilant about the expiration of the promotional period. Once the zero-interest period concludes, the loan may revert to a higher interest rate, potentially catching borrowers off guard.

- Eligibility Criteria: Meeting the eligibility criteria for a 0% interest personal loan may be challenging for some individuals. Lenders often require a good credit score and a stable financial history, making it essential for borrowers to assess their eligibility before applying.

- Origination Fees: Some lenders may charge origination fees even for 0% interest loans. Borrowers should carefully review the terms and conditions to understand all associated fees and costs.

- Impact on Credit Score: While repaying a 0% interest loan can have a positive impact on a credit score, missed payments or defaults can harm one’s credit history. Borrowers should be mindful of their financial capabilities and only take on what they can comfortably repay.

Conclusion:

A personal loan with 0% interest can be a valuable financial tool for those who meet the eligibility criteria and can benefit from the cost savings during the promotional period. However, it’s crucial for borrowers to approach such loans with a clear understanding of the terms, potential pitfalls, and their own financial situation.

Before embarking on the journey of securing a 0% interest personal loan, individuals should carefully research different lenders, compare offers, and assess their own financial health. By doing so, borrowers can maximize the benefits of these loans while minimizing the risks, ensuring a positive and financially prudent borrowing experience.