Introduction:

New York City, the epitome of hustle and bustle, stands as a beacon of opportunity for entrepreneurs across the globe. New York City to Loan for Your Hotel Venture. Among its myriad ventures, the hotel industry reigns supreme, catering to millions of tourists and business travelers annually. However, breaking into this competitive arena requires not only vision and dedication but also substantial financial investment. In this article, we explore the intricacies of securing a loan for a hotel in the vibrant landscape of New York City.

Understanding the Landscape:

The allure of New York City is undeniable, drawing tourists with its iconic landmarks, diverse culture, and thriving economy. Consequently, the demand for accommodation is perpetual, making the hotel industry a lucrative endeavor for aspiring entrepreneurs. However, entering this market demands meticulous planning and financial backing.

Challenges in Hotel Financing:

Securing financing for a hotel venture in New York City presents a myriad of challenges. Firstly, the exorbitant real estate prices make acquisition costs staggering, necessitating substantial capital upfront. Additionally, lenders are inherently cautious due to the volatile nature of the hospitality sector, requiring comprehensive business plans and feasibility studies to mitigate risk.

Types of Loans Available:

Various financing options are available to entrepreneurs seeking to establish a hotel in New York City. Traditional bank loans remain a popular choice, offering competitive interest rates and favorable terms for well-established businesses with solid credit histories. Alternatively, Small Business Administration (SBA) loans provide government-backed funding, ideal for startups or businesses with limited collateral.

Furthermore, alternative lending institutions and private investors offer flexibility in loan structures, albeit at higher interest rates. Crowdfunding platforms have also emerged as viable options, allowing entrepreneurs to pool resources from multiple investors.

Navigating the Loan Application Process:

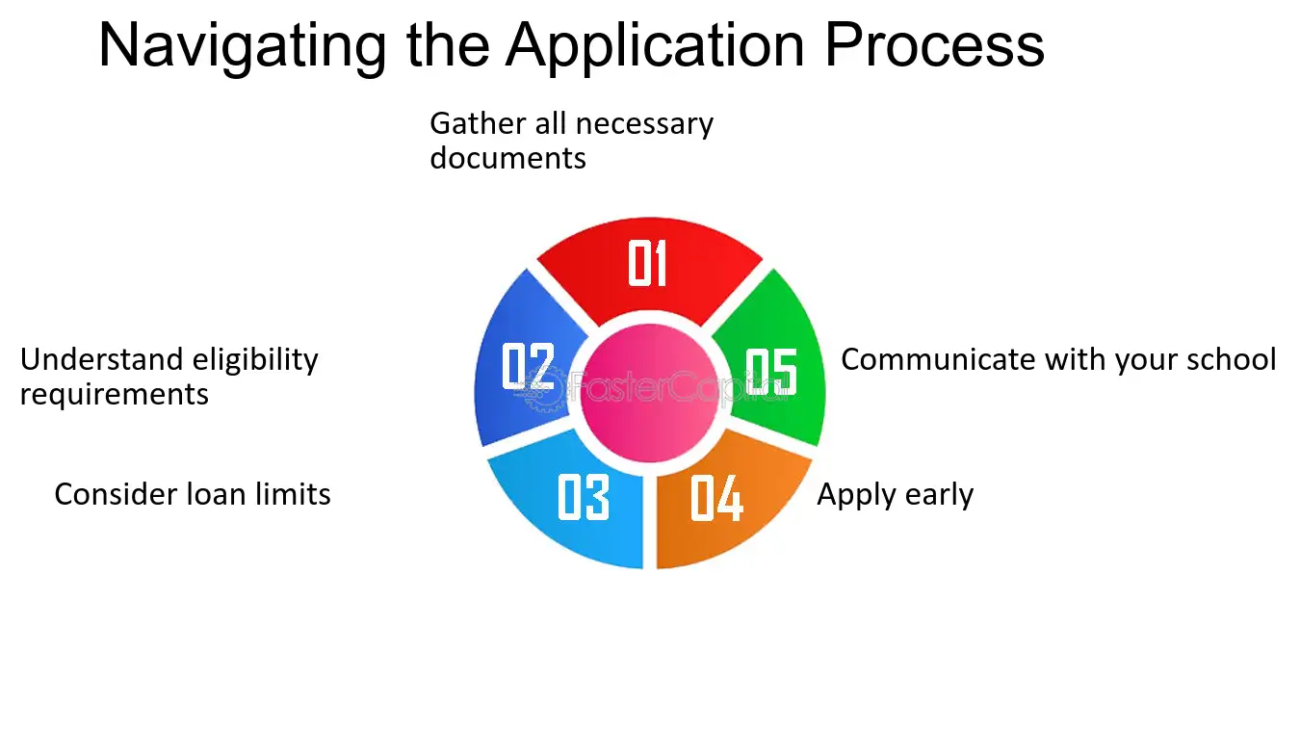

Navigating the loan application process can be daunting, requiring meticulous preparation and attention to detail. Begin by compiling a comprehensive business plan outlining the hotel’s concept, target market, competitive analysis, and financial projections. Additionally, assemble all requisite documentation, including financial statements, tax returns, and collateral valuations. New York City to Loan for Your Hotel Venture

Next, identify suitable lenders based on your specific financing needs and preferences. Research each institution’s lending criteria, interest rates, and repayment terms to determine compatibility with your business objectives. Establishing a strong rapport with potential lenders through open communication and transparency can enhance your credibility and improve your chances of securing financing.

Mitigating Risks:

Despite meticulous planning, the hotel industry inherently carries risks, ranging from economic downturns to unforeseen disasters. Mitigate these risks by conducting thorough market research, identifying potential threats, and implementing contingency plans. Additionally, maintaining a robust financial cushion and securing adequate insurance coverage can safeguard your investment against unforeseen challenges.

Conclusion:

Establishing a hotel in the bustling metropolis of New York City is a daunting yet rewarding endeavor. Securing financing is a pivotal step in realizing your entrepreneurial aspirations, necessitating careful planning, perseverance, and strategic decision-making. By understanding the intricacies of the loan application process and mitigating inherent risks, you can navigate the competitive landscape of the hospitality industry and embark on a successful venture in the heart of the Big Apple.