Introduction

Navigating the Complexities of Loan Administration Loan administration is a critical aspect of the financial landscape that involves the management and oversight of loans throughout their lifecycle. Whether it’s a mortgage, personal loan, or business financing, effective loan administration ensures that borrowers and lenders adhere to agreed-upon terms and conditions, ultimately contributing to a smooth and successful borrowing experience. In this comprehensive guide, we will explore the key components of loan administration, its importance in various sectors, and the evolving landscape of loan servicing in the financial industry.

Understanding Loan Administration:

- Definition and Scope: Loan administration encompasses the processes and activities involved in the ongoing management of loans after they have been disbursed. It includes tasks such as loan servicing, payment processing, monitoring borrower compliance, and addressing any issues that may arise during the loan term. The goal is to ensure that both borrowers and lenders fulfill their respective obligations in accordance with the loan agreement.

- Key Players in Loan Administration: Several entities play crucial roles in the loan administration process. These include financial institutions (banks, credit unions), loan servicers, and borrowers. While the lender initially originates the loan, loan servicers step in to handle day-to-day management tasks, allowing lenders to focus on their core functions.

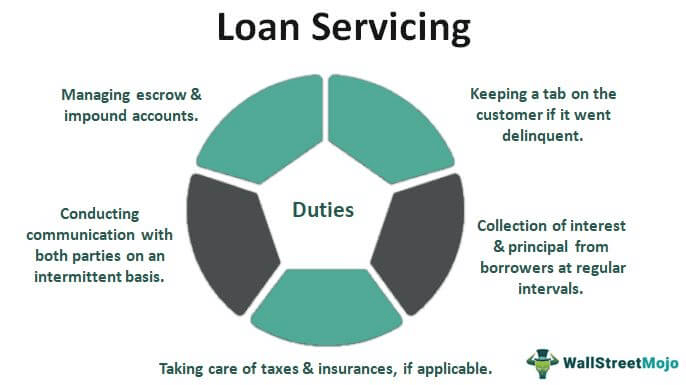

- Loan Servicing: Loan servicing, a subset of loan administration, involves the collection of payments, maintenance of borrower records, and communication with borrowers regarding any changes or issues related to the loan. Loan servicers act as intermediaries between lenders and borrowers, ensuring that payments are processed accurately and addressing inquiries or concerns from borrowers.

Importance of Effective Loan Administration:

- Risk Mitigation: Effective loan administration is integral to risk mitigation for both lenders and borrowers. Lenders use thorough loan administration processes to monitor borrower compliance and identify any potential red flags. Conversely, borrowers benefit from the assurance that their payments are accurately recorded, reducing the risk of disputes or misunderstandings.

- Compliance and Regulations: The financial industry is subject to numerous regulations and compliance requirements. Loan administration ensures that both lenders and borrowers adhere to these regulations, avoiding legal complications and penalties. Compliance includes accurate record-keeping, fair lending practices, and adherence to interest rate regulations.

- Customer Satisfaction: For borrowers, a positive loan administration experience translates into increased satisfaction. Satisfied borrowers are more likely to remain loyal and recommend the lender to others.

- Efficient Payment Processing: Timely and efficient payment processing is a cornerstone of effective loan administration. This includes the accurate recording of payments, handling escrow accounts, and promptly addressing any issues related to payment processing. Efficient systems contribute to a smoother borrower experience and help lenders manage their cash flow effectively.

- Default Prevention and Management: Loan administration plays a crucial role in identifying early signs of financial distress or potential default.

The Evolving Landscape of Loan Administration:

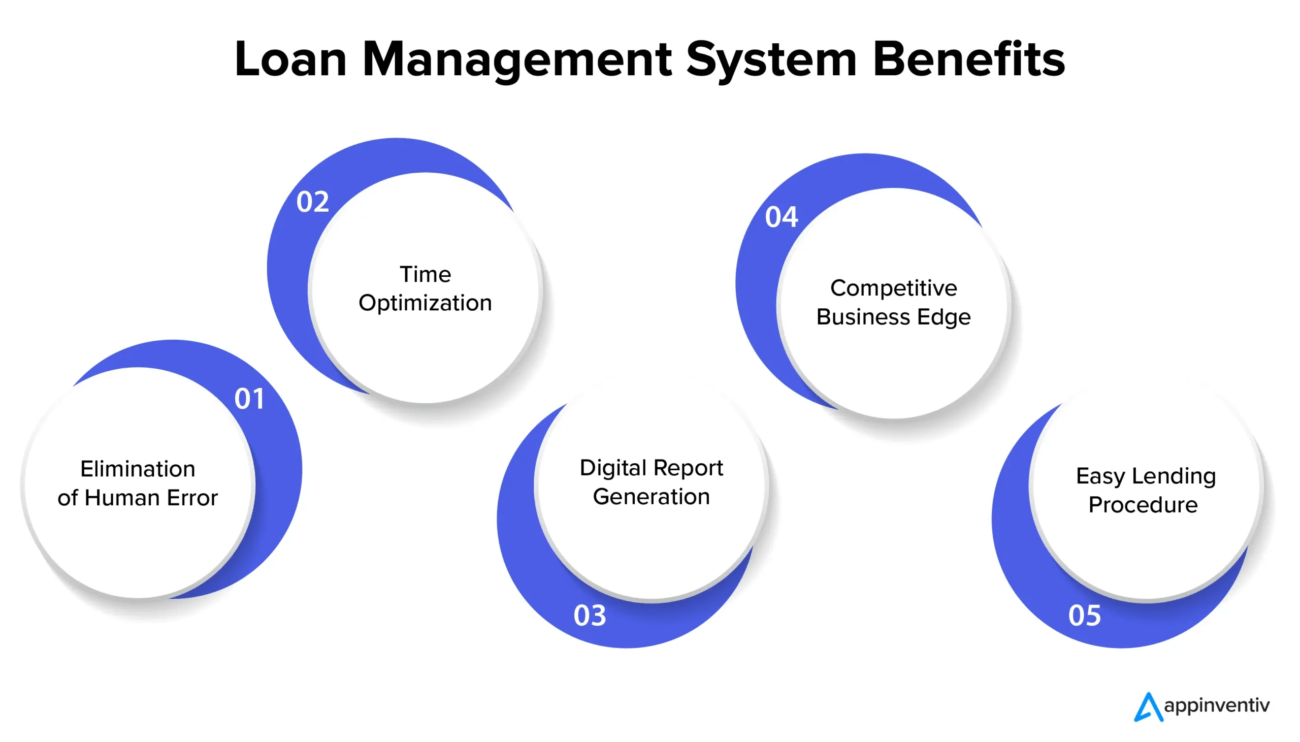

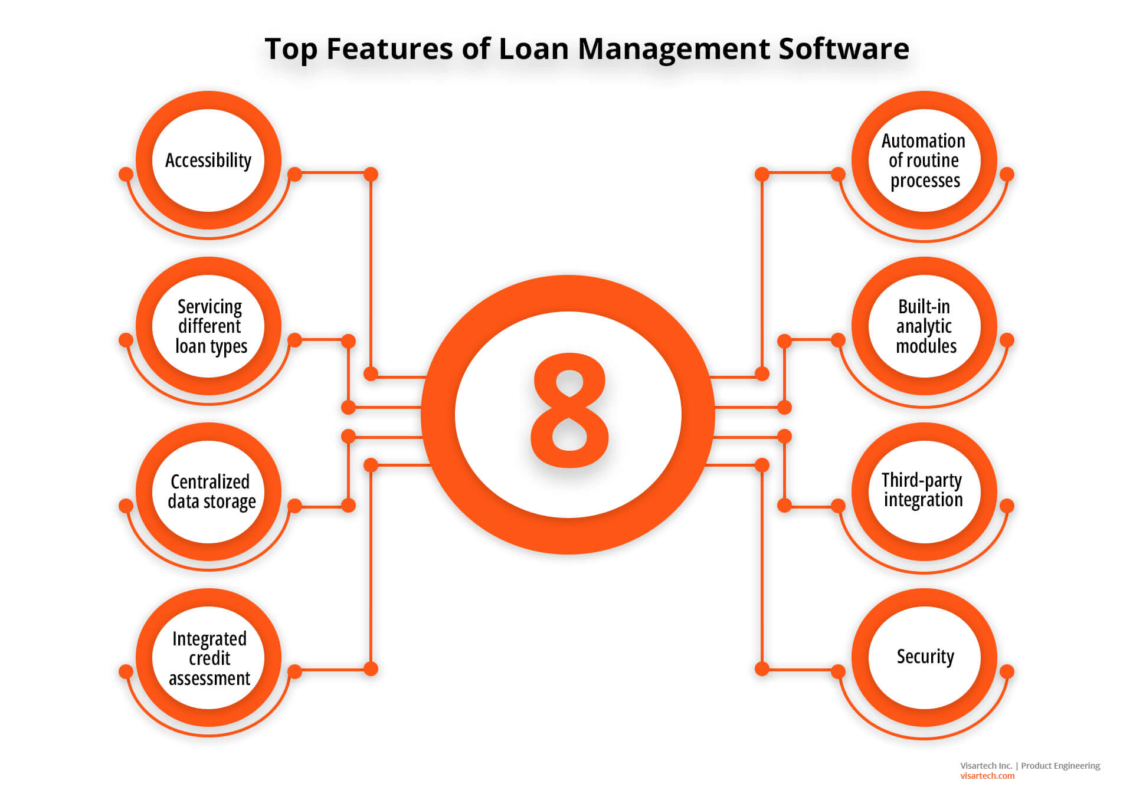

- Technology Integration: Navigating the Complexities of Loan Administration Advancements in technology have significantly impacted the field of loan administration. Automated systems and software solutions streamline processes, reducing the likelihood of errors and improving overall efficiency. Technology also enables real-time communication between borrowers, lenders, and loan servicers, enhancing transparency and responsiveness.

- Digital Payment Platforms: The rise of digital payment platforms has transformed the way loan payments are processed.

- Data Analytics and Risk Management: Data analytics has become a powerful tool in loan administration for risk management and decision-making. Lenders can leverage data to assess borrower behavior, predict potential defaults, and tailor loan terms to individual risk profiles. This data-driven approach enhances the efficiency and effectiveness of loan administration processes.

- Financial institutions must stay vigilant to adapt their loan administration practices to comply with evolving regulations. This includes addressing challenges related to privacy, data protection, and cybersecurity.

- Personalized Customer Experiences: As customer expectations evolve, lenders are focusing on providing personalized experiences throughout the loan administration process. This includes tailored communication, user-friendly interfaces, and proactive support. Personalization not only enhances customer satisfaction but also fosters long-term relationships between borrowers and lenders.

Best Practices in Loan Administration:

- Clear Communication: Establishing clear lines of communication between lenders, loan servicers, and borrowers is paramount. Providing transparent information about loan terms, payment schedules, and potential changes ensures that all parties are on the same page, reducing the risk of misunderstandings.

- Technology Adoption: Embracing technology solutions for loan administration can significantly improve efficiency and accuracy. Automated payment processing, digital document management, and data analytics contribute to a more streamlined and responsive loan administration process.

- Regular Audits and Compliance Checks: Financial institutions should conduct regular audits of their loan administration processes to ensure compliance with regulations and internal policies. Identifying and addressing any compliance issues proactively helps prevent legal complications and maintains the integrity of the loan portfolio.

- Proactive Default Prevention: Implementing measures for proactive default prevention is a best practice in loan administration. This may involve early intervention strategies, such as loan restructuring or financial counseling, to address potential issues before they escalate.

- Keeping staff updated on industry best practices, compliance requirements, and technology advancements contributes to a well-informed and capable workforce.

Conclusion:

Navigating the Complexities of Loan Administration Effective loan administration is a cornerstone of the financial industry, ensuring that the borrowing and lending process operates smoothly and in accordance with regulations. As technology continues to shape the landscape of loan administration, financial institutions must adapt, embracing automation and data-driven approaches to enhance efficiency and customer experiences. By prioritizing clear communication, proactive risk management, and adherence to compliance standards, lenders and loan servicers can navigate the complexities of loan administration successfully, ultimately contributing to the stability and growth of the financial sector.

2 Comments on “Complexities of Loan Administration”