Introduction

Securing a higher education in the United States has long been a dream for many aspiring students around the world. However, the costs associated with studying in the USA can be daunting. From tuition fees to living expenses, the financial burden can seem insurmountable. Thankfully, various loan options are available to help students pursue their academic goals. In this comprehensive guide, we will explore the different types of loans for USA university education, eligibility criteria, application processes, and tips for managing student loans responsibly.

Understanding the Types of Loans

1. Federal Student Loans

The United States Department of Education offers federal student loans, which are among the most popular choices for financing higher education. These loans come with fixed interest rates and flexible repayment plans, making them a feasible option for many students. The two main types of federal student loans are subsidized and unsubsidized, each with its own set of advantages.

Subsidized loans are need-based, meaning the government covers the interest while the borrower is in school. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed. Both types offer grace periods after graduation before repayment begins.

2. Private Student Loans

In addition to federal options, private lenders also provide student loans to cover educational expenses. Private loans may have variable interest rates and less flexible repayment terms than federal loans. Interest rates are typically based on creditworthiness, so it’s crucial for students to have a good credit score or a cosigner with one.

While private loans can be used to bridge the gap when federal aid falls short, they should be approached with caution due to their potentially higher costs and less favorable terms.

Eligibility Criteria and Application Process

1. Federal Student Loans

To qualify for federal student loans, applicants must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA takes into account the financial situation of the student and their family to determine eligibility for various forms of financial aid, including grants and loans.

Eligibility is primarily based on financial need, and most students are eligible for some form of federal aid. The application process is annual, so students need to submit the FAFSA for each academic year they require financial assistance.

2. Private Student Loans

Eligibility criteria for private student loans vary among lenders, but they generally consider factors such as credit history, income, and employment status. Some lenders may require a cosigner if the student lacks a robust credit history.

The application process for private loans typically involves filling out an online application with the chosen lender. It’s essential to compare multiple lenders to find the best interest rates and terms. Additionally, applicants should be prepared to provide documentation, such as proof of enrollment and income.

Tips for Responsible Loan Management

1. Understand the Terms

Before accepting any loan, it’s crucial for students and their families to thoroughly understand the terms and conditions. This includes interest rates, repayment plans, and any fees associated with the loan. Federal loans generally offer more borrower-friendly terms, so they should be prioritized when available.

2. Borrow Only What’s Necessary

While loans provide financial support, it’s essential to borrow only what is necessary to cover educational expenses. Creating a budget and exploring other forms of financial aid, such as scholarships and grants, can help minimize the overall debt burden.

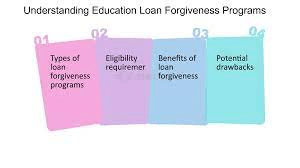

3. Explore Loan Forgiveness Programs

Certain federal loan programs offer forgiveness options for borrowers who meet specific criteria. Public Service Loan Forgiveness (PSLF) is one such program available to borrowers working in qualifying public service jobs. Understanding and planning for these programs can significantly impact long-term financial well-being.

4. Keep Track of Repayment

Once students graduate or leave school, it’s crucial to stay informed about the repayment process. Federal loans typically offer various repayment plans, including income-driven options, which can make monthly payments more manageable.

Conclusion

While pursuing higher education in the USA comes with a significant financial commitment, loans can provide a pathway to achieving academic goals. Understanding the types of loans available, eligibility criteria, and responsible management practices are essential steps in navigating the financial landscape of university education in the United States. By making informed decisions and embracing a proactive approach to loan management, students can embark on their academic journey with confidence and financial stability.