Introduction

In the vast landscape of personal finance, understanding the intricacies of loan repayment is crucial for individuals navigating the ever-evolving economic terrain in the United States. Whether you’ve borrowed to pursue higher education, purchase a home, or start a business, comprehending the nuances of loan repayment is essential for financial well-being. This article will delve into the various aspects of loan repayment in the USA, shedding light on key considerations and offering insights to help borrowers make informed decisions.

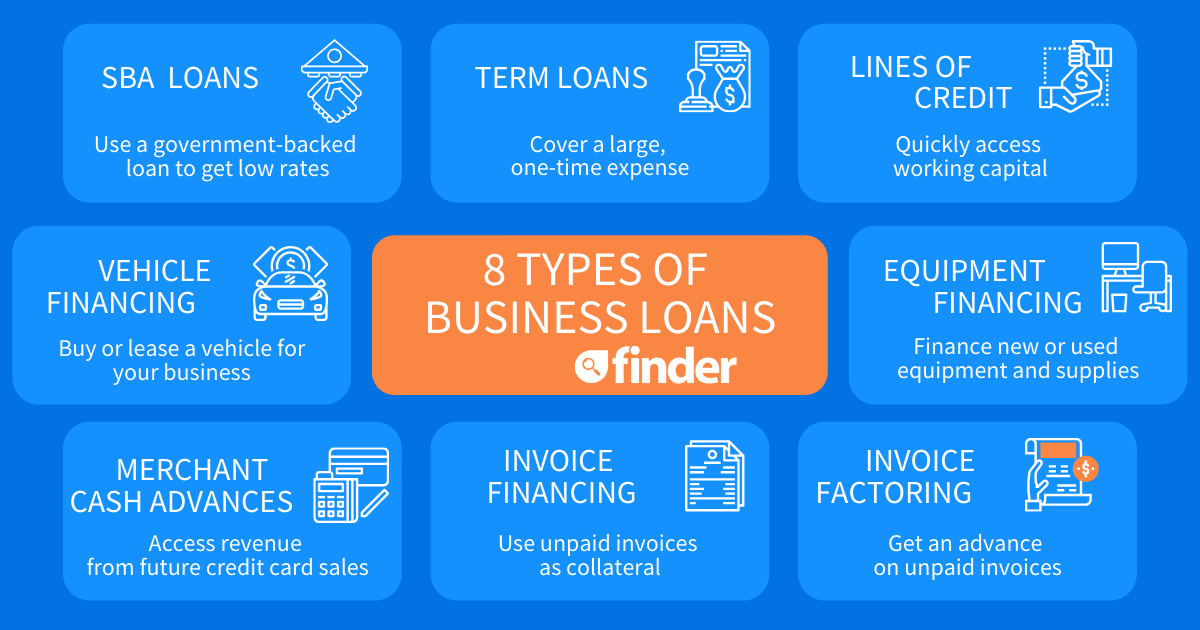

1. Types of Loans in the USA

The United States offers a diverse array of loans to meet the financial needs of its citizens. Common types include student loans, mortgages, auto loans, and personal loans. Each comes with its own set of terms, interest rates, and repayment plans. Understanding the specific details of your loan is the first step towards effective repayment.

2. Student Loan Repayment

For many Americans, student loans are a gateway to higher education but can also be a source of financial stress. Federal student loans typically offer various repayment plans, including Income-Driven Repayment (IDR) options that adjust payments based on income and family size. Private student loans may have different terms, and it’s crucial to communicate with lenders to explore options in times of financial hardship.

3. Mortgage Repayment Strategies

Homeownership is a significant milestone for many individuals, often facilitated through a mortgage. Managing mortgage repayments involves understanding the terms, interest rates, and potential refinancing opportunities. Some homeowners opt for accelerated payment plans to reduce the overall interest paid over the life of the loan, while others explore refinancing to take advantage of lower interest rates.

4. Auto Loan Repayment Considerations

Auto loans are another common form of debt in the USA, allowing individuals to finance vehicle purchases. Effective auto loan repayment involves budgeting for monthly payments, understanding the loan duration, and being aware of potential penalties for late payments. Refinancing and negotiating with lenders can be explored to improve loan terms in certain situations.

5. Personal Loan Repayment Strategies

Personal loans provide a flexible financial solution for various purposes, from debt consolidation to unexpected expenses. Repaying a personal loan requires a clear understanding of the terms, including interest rates and any associated fees. Developing a realistic budget and exploring options for early repayment can help borrowers manage personal loans effectively.

6. The Importance of Budgeting

Regardless of the type of loan, successful repayment often hinges on effective budgeting. Creating a comprehensive budget that includes all monthly expenses, alongside loan repayments, allows individuals to prioritize payments and avoid financial strain. Utilizing budgeting tools and apps can streamline this process, providing a clearer picture of one’s financial health.

7. Loan Forgiveness and Discharge Programs

In certain situations, borrowers may qualify for loan forgiveness or discharge programs. Federal student loans, for example, may be forgiven under specific conditions, such as public service employment or income-driven repayment plans. Understanding the eligibility criteria and application processes for such programs is crucial for those seeking relief from their financial obligations.

8. Dealing with Financial Hardship

Life is unpredictable, and financial hardships can arise unexpectedly. Whether due to job loss, medical expenses, or other unforeseen circumstances, it’s important to communicate with lenders proactively. Many lenders offer hardship programs that may temporarily reduce or suspend payments, providing breathing room for borrowers facing challenges.

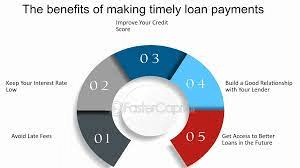

9. Credit Implications of Loan Repayment

Timely loan repayment is not only crucial for financial stability but also for maintaining a positive credit history. A good credit score opens doors to favorable interest rates and increased financial opportunities. On the other hand, late or missed payments can negatively impact credit scores, potentially limiting access to future credit.

10. Seeking Professional Advice

For individuals facing complex financial situations or struggling to navigate loan repayment, seeking professional advice can be invaluable. Financial advisors and credit counseling services can provide personalized guidance, helping borrowers make informed decisions tailored to their unique circumstances.

Conclusion

Loan repayment in the USA is a multifaceted process that requires careful consideration and proactive financial management. Understanding the terms of your loans, exploring repayment strategies, and being aware of available resources are essential components of a successful repayment journey. By staying informed, communicating with lenders, and adapting to changing circumstances, borrowers can navigate the intricacies of loan repayment, ultimately achieving financial well-being in the dynamic landscape of personal finance.

2 Comments on “Loan Repayment in the USA”