Introduction:

The landscape of loan demand in the United States is a dynamic and complex terrain, shaped by a myriad of economic, social, and regulatory factors. As the heartbeat of the world economy, the USA experiences fluctuations in loan demand that reflect the changing needs and aspirations of businesses and individuals. This article delves into the key trends, factors, and implications surrounding loan demand in the USA, providing a comprehensive overview of this crucial aspect of the financial ecosystem.

Trends in Loan Demand:

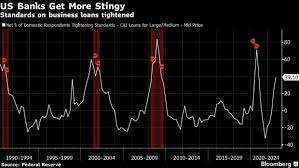

Understanding the current trends in loan demand is essential for gaining insights into the economic pulse of the nation. In recent years, the USA has witnessed a fluctuating pattern in loan demand across various sectors. The COVID-19 pandemic, for instance, led to an initial surge in demand for emergency loans as businesses grappled with unprecedented challenges. However, as the economy gradually recovered, the demand shifted towards more traditional forms of financing, such as mortgages and consumer loans.

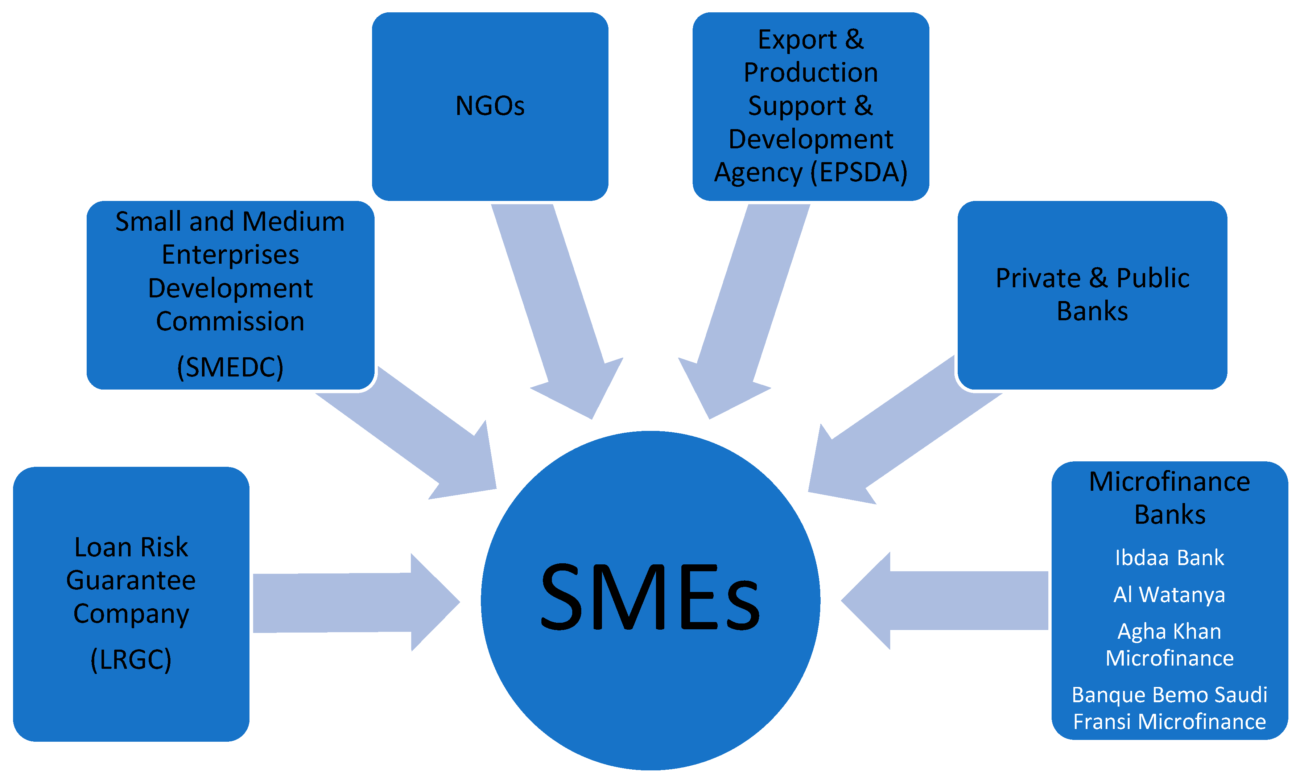

Small and Medium-Sized Enterprises (SMEs) as Drivers of Loan Demand

Small and medium-sized enterprises (SMEs) have been a significant driver of loan demand in the USA. These businesses play a crucial role in job creation and economic growth, and their funding needs have a direct impact on the overall demand for loans. Government initiatives and stimulus packages have also played a pivotal role in influencing the trends in loan demand, especially during times of economic uncertainty.

Factors Influencing Loan Demand:

Several factors contribute to the ebb and flow of loan demand in the USA. Economic conditions, interest rates, regulatory policies, and technological advancements all play crucial roles in shaping the borrowing landscape.

Economic Conditions and Loan Demand

- Economic Conditions: The overall health of the economy has a profound impact on loan demand. During periods of economic expansion, businesses often seek loans to finance expansion projects, while consumers may be more inclined to borrow for major purchases. Conversely, during economic downturns, loan demand may decrease as businesses adopt a more conservative approach, and individuals may defer non-essential borrowing.

Implications of Loan Demand:

Understanding the implications of loan demand is crucial for policymakers, financial institutions, and consumers alike. The following aspects shed light on the broader consequences of fluctuations in loan demand.

- Economic Growth: The demand for loans is intricately linked to economic growth. An uptick in loan demand, particularly in sectors like manufacturing, construction, and technology, often signals a robust and expanding economy. Conversely, a decline in loan demand may be indicative of economic challenges that warrant attention and intervention.

- Financial Inclusion: A nuanced analysis of loan demand can reveal insights into financial inclusion. Examining which demographic groups and businesses are driving loan demand provides an opportunity to address disparities and ensure that financial services are accessible to all segments of the population.

Conclusion:

The dynamics of loan demand in the USA are a multifaceted interplay of economic conditions, regulatory frameworks, technological advancements, and societal trends. Keeping a finger on the pulse of loan demand is crucial for stakeholders ranging from policymakers and financial institutions to businesses and consumers. As the USA navigates the complexities of a rapidly changing economic landscape, a nuanced understanding of loan demand will be essential for fostering sustainable growth and financial well-being

One Comment on “Loan Demand in the USA”