Introduction:

In the ever-evolving landscape of personal finance, individuals often find themselves faced with important decisions regarding loans. Whether it’s for purchasing a home, financing education, or consolidating debt, understanding the financial implications of a loan is crucial. To aid in this process, loan calculators have become indispensable tools for USA residents.

I. The Importance of Loan Calculators:

Financial decisions, especially those related to loans, have long-term consequences. Loan calculators play a pivotal role in empowering individuals with the knowledge they need to make informed choices. Here are some key reasons why loan calculators are indispensable:

- Budgeting and Planning: Loan calculators provide a clear picture of the monthly payments and overall cost of a loan. This information is invaluable for budgeting purposes, helping individuals assess whether a particular loan aligns with their financial goals.

- Comparing Loan Options: The financial market offers a plethora of loan options with varying interest rates and terms. Loan calculators allow users to compare these options side by side, enabling them to choose the most cost-effective and suitable loan for their needs.

- Understanding Affordability: By inputting different loan scenarios into a calculator, users can quickly determine the affordability of a loan. This prevents overcommitting to a financial obligation that may strain their budget.

II. How Loan Calculators Work:

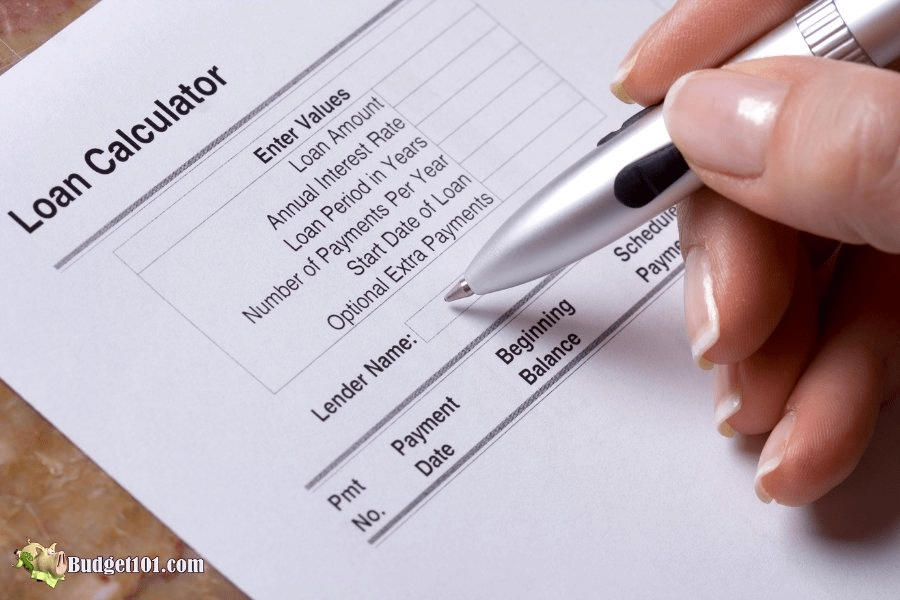

Loan calculators use a set of mathematical formulas to compute various aspects of a loan, providing users with a detailed breakdown of the financial commitment involved. The primary factors considered by loan calculators include:

- Loan Amount: Users input the amount they intend to borrow. This is the principal amount, and it serves as the foundation for all subsequent calculations.

- Interest Rate: The interest rate is a critical factor in determining the cost of a loan. Loan calculators take this rate into account when computing monthly payments and the overall interest paid over the life of the loan.

- Loan Term: The duration of the loan, often expressed in years, influences monthly payments. A longer loan term typically results in lower monthly payments but may lead to higher overall interest payments.

III. Types of Loan Calculators:

Different types of loan calculators cater to specific financial needs. Here are some common ones:

- Mortgage Calculators: Tailored for homebuyers, mortgage calculators help users estimate monthly mortgage payments, including principal and interest.

- Auto Loan Calculators: Ideal for those considering financing a vehicle, these calculators assist in determining the monthly payments and total cost of an auto loan.

- Personal Loan Calculators: For unsecured personal loans, these calculators help users understand the financial implications of borrowing a specific amount.

IV. Benefits of Using Loan Calculators for USA Residents:

- Informed Decision-Making: Loan calculators empower individuals to make well-informed decisions by providing a transparent view of the financial commitment associated with a loan.

- Time and Money Savings: By quickly comparing various loan options, users save time that would otherwise be spent manually crunching numbers. This efficiency translates into potential savings over the life of the loan.

Conclusion:

In the complex world of personal finance, loan calculators for USA residents are invaluable tools that foster financial literacy and responsible decision-making. Whether planning to purchase a home, finance education, or consolidate debt, these calculators provide the clarity needed to navigate the intricacies of loans. By understanding the mechanics of loan calculators and leveraging their benefits, individuals can embark on their financial journeys with confidence, knowing they have the tools to make informed and prudent choices.

2 Comments on “Loan Calculators for USA Residents”