Introduction

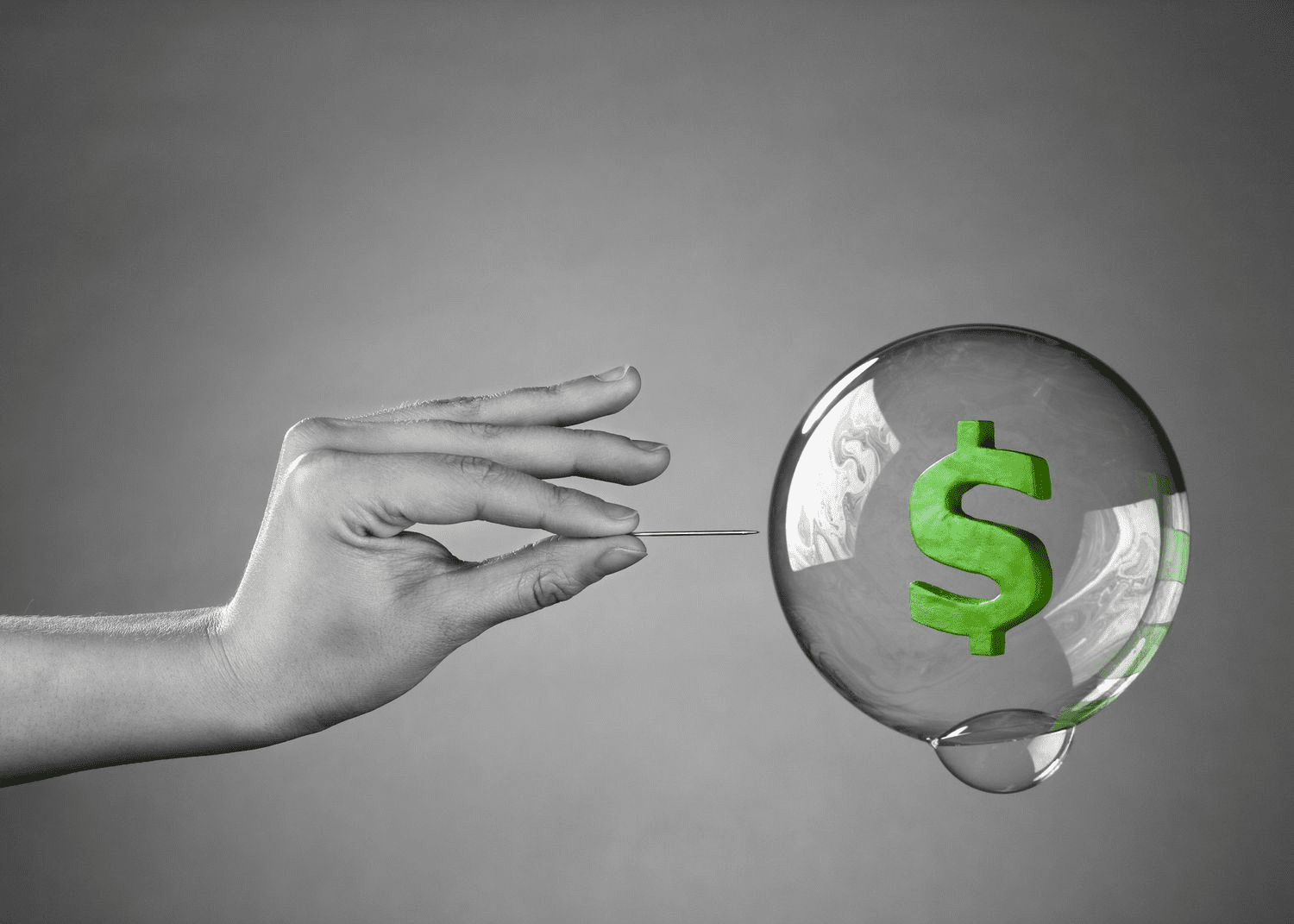

Financial bubbles, characterized by a detachment of asset prices from their intrinsic value due to speculative fervor, can pose significant risks to investors and the economy. This blog outlines effective strategies for responding to financial bubbles, emphasizing prudent actions to mitigate potential losses.

Recognize the signs of a bubble

The initial step in responding to a financial bubble is recognizing its indicators. Rapid, unjustified price increases, excessive speculation, high leverage, and irrational exuberance among investors are common signs. Vigilance and awareness are crucial for identifying these warning signals.

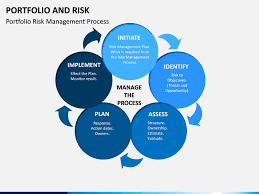

Manage your portfolio risk

Suspecting a forming bubble necessitates proactive portfolio risk management. Diversification across various asset classes and sectors is key. Avoiding excessive leverage is equally vital to prevent magnified losses during a market downturn.

Maintain a long-term investment strategy

Investors adhering to a long-term investment strategy are better equipped to weather the storm of a financial bubble. Long-term focus minimizes susceptibility to short-term market fluctuations, encouraging attention to underlying company fundamentals.

Avoid following the herd

In a financial bubble, the temptation to follow the herd and invest in surging assets can be strong. However, this strategy often leads to substantial losses when the bubble bursts. Disciplined investing based on sound principles is crucial to avoid falling prey to herd mentality.

Be prepared to take action

Preparedness is paramount when anticipating or witnessing a financial bubble. Taking action may involve selling at-risk assets, hedging the portfolio against market downturns, or having a well-defined plan for responding to sudden market shifts. Preparedness enhances the ability to navigate volatile market conditions.

Conclusion

In conclusion, financial bubbles pose significant threats to investors and the broader economy. Responding effectively involves recognizing bubble signs, managing portfolio risk, maintaining a long-term investment approach, avoiding herd behavior, and being prepared to take decisive action. By following these strategies, investors can safeguard themselves against potential negative consequences associated with financial bubbles.

5 Comments on “How To Respond To Financial Bubbles”