Introduction

Embarking on the adventure of living abroad as a U.S. expatriate is an exciting journey, but amidst the thrill of new experiences, it’s essential to consider your financial security. Life insurance for U.S. expats is a crucial aspect of planning, providing peace of mind and protection for you and your loved ones in unforeseen circumstances. In this comprehensive guide, we’ll explore the importance of life insurance for expatriates, the challenges they may face, and how to navigate the options available.

Understanding the Unique Challenges for Expatriates

1. Global Mobility and Insurance Coverage

Living as an expatriate often involves a mobile lifestyle, and traditional life insurance policies may not seamlessly adapt to this global mobility. It’s vital to assess how your existing life insurance, if any, aligns with your expatriate status.

2. Currency and Financial Considerations

Managing finances across different currencies can be complex for expatriates. Life insurance policies need to account for currency fluctuations and ensure that beneficiaries receive benefits in a way that aligns with their financial needs.

3. Diverse Legal and Regulatory Environments

The legal and regulatory landscape for insurance varies from country to country. Expatriates must navigate these complexities to ensure that their life insurance policies remain valid and effective in the host country.

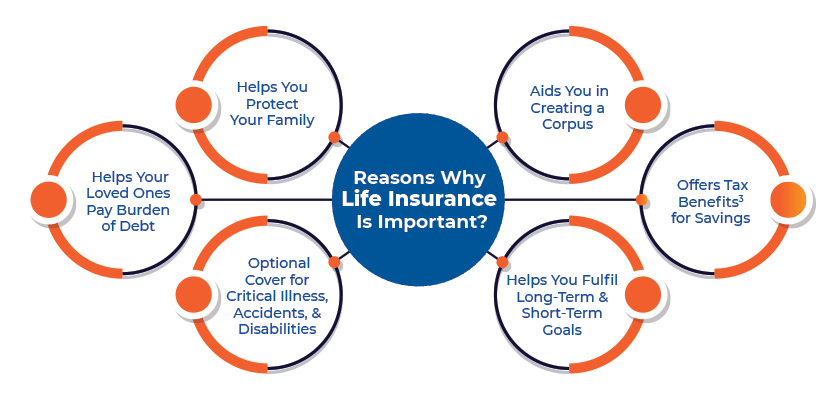

The Importance of Life Insurance for Expatriates

1. Financial Security for Dependents

Life insurance provides a financial safety net for your dependents in the event of your untimely demise. This is particularly crucial for expatriates, as the distance from the home country may amplify the financial challenges for their loved ones.

2. Covering Outstanding Debts

Expatriates often have financial commitments such as mortgages, loans, or other debts. Life insurance ensures that these obligations are covered, preventing them from becoming a burden on surviving family members.

3. Education and Future Planning

If you have children, life insurance can contribute to their education and future planning. The benefits from a life insurance policy can be earmarked for specific purposes, ensuring that your family’s aspirations are financially supported.

4. Facilitating Repatriation

In the unfortunate event of a U.S. expatriate’s demise, repatriation costs can be significant. Life insurance can assist in covering the expenses associated with returning the deceased’s remains to the home country.

Types of Life Insurance for U.S. Expatriates

1. International Term Life Insurance

International term life insurance provides coverage for a specified term, offering a death benefit if the insured passes away during that period. This type of policy can be tailored to the expatriate lifestyle, providing coverage regardless of the location.

2. Global Whole Life Insurance

Global whole life insurance provides coverage for the entire lifetime of the insured. It accumulates cash value over time and may offer investment opportunities. This type of policy can provide a stable, long-term solution for U.S. expatriates.

3. Group Expat Life Insurance

Some employers offer group expat life insurance as part of their benefits package for employees working overseas. While this coverage is convenient, it’s essential to evaluate its adequacy and consider supplemental policies if needed.

4. International Universal Life Insurance

International universal life insurance combines life insurance coverage with an investment component. Policyholders can adjust their premium payments and death benefits, providing flexibility that may be advantageous for expatriates with evolving financial needs.

Navigating the Selection Process

1. Assessing Coverage Needs

Start by evaluating your specific coverage needs. Consider factors such as outstanding debts, financial goals, and the standard of living you want to provide for your dependents.

2. Understanding Policy Terms

Different life insurance policies have varying terms, conditions, and exclusions. Ensure a comprehensive understanding of the policy terms, including coverage limits, premium amounts, and any restrictions related to expatriate living.

3. Factoring in Currency Considerations

Given the potential for currency fluctuations, expatriates should consider how their life insurance benefits will be paid out. opt for policies that offer flexibility or currency-specific options.

4. Researching Insurers Specializing in Expatriate Coverage

Not all insurance providers cater specifically to the needs of U.S. expatriates. Research insurers with expertise in international coverage to ensure they understand the unique challenges faced by expatriates.

5. Considering Supplemental Coverage

Depending on your circumstances, supplemental coverage may be necessary. This could include additional policies for specific needs or riders that enhance the coverage of your primary life insurance policy.

Overcoming Challenges in Obtaining Coverage

1. Medical Underwriting

Expatriates may encounter challenges with medical underwriting, especially if they reside in a location with limited access to healthcare resources. It’s crucial to provide comprehensive medical information to facilitate the underwriting process.

2. Country-Specific Restrictions

Insurance regulations vary by country, and some nations may have specific restrictions on the types of coverage available to expatriates. Research the regulatory environment of your host country to navigate potential restrictions.

3. Lifestyle and Occupation Considerations

Certain lifestyles or occupations, such as engaging in hazardous activities, may impact your insurability. Be transparent about your lifestyle and occupation to ensure accurate underwriting and coverage.

Conclusion

Securing life insurance as a U.S. expatriate is a proactive step toward safeguarding your family’s financial well-being and ensuring that your aspirations for their future are supported. By understanding the unique challenges, exploring the types of insurance available, and navigating the selection process thoughtfully, expatriates can make informed decisions to protect their loved ones, regardless of their global location.

One Comment on “Future Abroad A Guide to Life Insurance for US Expats”