Introduction

In a globalized world, individuals from various corners of the globe seek opportunities in the United States. Whether for education, employment, or investment, these foreign nationals often find themselves in need of financial assistance to navigate the complexities of the American financial system. This article delves into the intricacies of foreign national loans in the USA, exploring the challenges and solutions associated with obtaining credit as a non-resident.

Understanding Foreign National Loans

Foreign national loans cater specifically to individuals who do not hold permanent residency or citizenship in the United States. Lenders acknowledge that the financial needs of non-residents differ from those of citizens, necessitating specialized loan products. These loans can serve various purposes, including financing education, purchasing real estate, or covering unexpected expenses.

Challenges Faced by Foreign Nationals

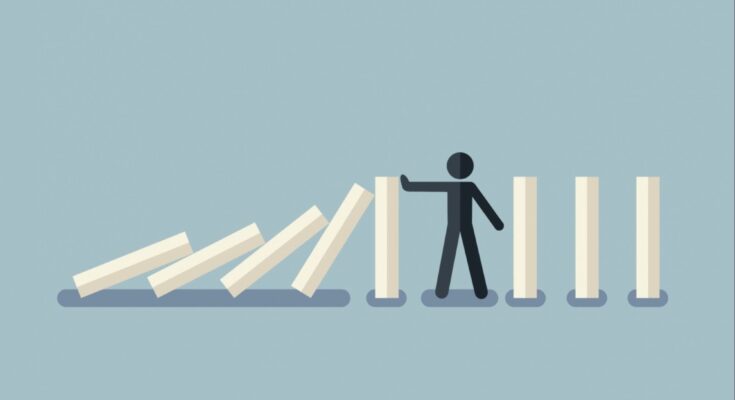

While the need for financial assistance is universal, foreign nationals encounter unique challenges when seeking loans in the USA. One of the primary hurdles is the absence of a credit history. Unlike U.S. citizens who build credit over time, non-residents often lack a local credit record, making it difficult for traditional lenders to assess their creditworthiness.

Types of Foreign National Loans

- Education Loans: Foreign students pursuing higher education in the USA often require financial assistance to cover tuition, accommodation, and living expenses. Some lenders offer student loans specifically designed for non-residents, considering factors like the applicant’s academic program, expected graduation date, and potential future employment.

- Mortgage Loans: Real estate investment is a common goal for many foreign nationals in the USA. Mortgage lenders may provide options tailored to non-residents, taking into account factors such as employment status, income, and the purpose of the property (investment or residence). Down payment requirements and interest rates may vary based on these factors.

Tips for Obtaining Foreign National Loans

- Establish a U.S. Bank Account: Opening a bank account in the USA is a crucial first step for foreign nationals. It provides a foundation for financial transactions and demonstrates stability to potential lenders. Some banks offer specialised accounts for non-residents, simplifying the process.

- Build Credit History: Building a credit history is essential for obtaining favourable loan terms. Non-residents can start by applying for a secured credit card or becoming an authorised user on someone else’s card. Timely payments and responsible credit use contribute positively to their credit profile.

Conclusion

Navigating the financial landscape as a foreign national in the USA requires a strategic approach and awareness of the challenges involved. While obtaining loans without a credit history or proper identification may be daunting.

One Comment on “Foreign National Loans in the USA”