The Rising Significance of Pet Insurance

Pets, whether cats, dogs, or other animals, play an integral role in the lives of millions of individuals and families worldwide. They offer companionship, emotional support, and often become cherished members of the household. However, like humans, pets are susceptible to health issues, accidents, and unforeseen emergencies. Veterinary care, while essential, can be expensive, and the financial burden of unexpected medical expenses can be overwhelming.

This is where pet insurance steps in to alleviate the financial strain associated with veterinary bills. Embracing pet insurance reflects a proactive approach to managing the health of one’s pets, ensuring that they receive prompt and necessary medical attention without compromising on the quality of care due to financial constraints.

Understanding Pet Insurance

Pet insurance operates on a similar principle to human health insurance, covering a range of veterinary expenses such as accidents, illnesses, surgeries, and preventive care. Policies can vary widely, offering different levels of coverage, deductibles, and reimbursement percentages. Some plans may include routine vaccinations and wellness check-ups, while others focus on more extensive coverage for emergencies and chronic conditions.

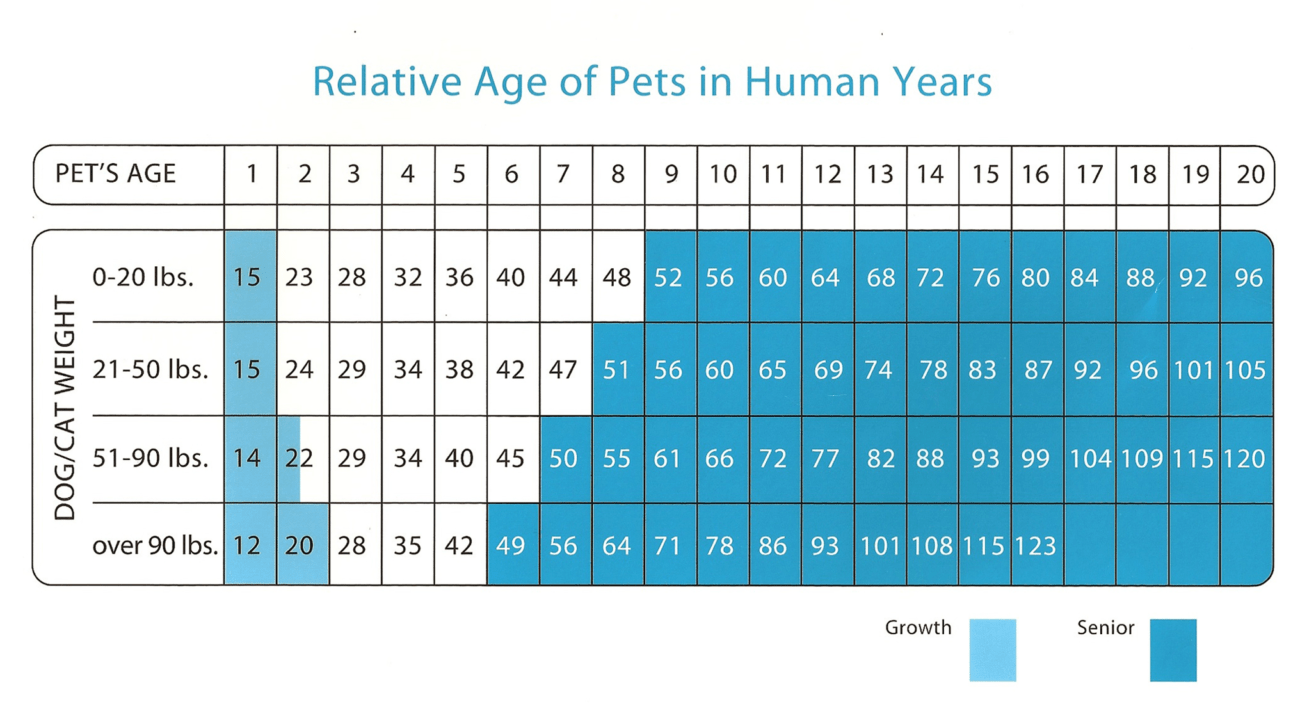

It’s crucial for pet owners to carefully review and compare policies to find the one that best suits their pets’ specific needs. Factors to consider include the pet’s age, breed, pre-existing conditions, and the owner’s budget. While younger pets may qualify for lower premiums, older animals may have a higher likelihood of developing health issues, impacting the cost and coverage of insurance plans.

Benefits of Embracing Pet Insurance

Financial Security

One of the primary advantages of pet insurance is the financial security it provides. Unexpected veterinary bills can be exorbitant, and having insurance ensures that pet owners are not forced to make difficult decisions about their pets’ health based on financial constraints. Instead, they can focus on providing the necessary care without compromising their own financial stability.

Comprehensive Coverage

Pet insurance covers a wide array of medical expenses, including accidents, injuries, illnesses, surgeries, and sometimes even routine care. This comprehensive coverage ensures that pets can receive the necessary treatment regardless of the nature of the health issue.

Peace of Mind

Knowing that your pet is covered by insurance can provide peace of mind. Pet owners can make decisions based on their pet’s health needs rather than worrying about the associated costs. This peace of mind extends to preventive care as well, encouraging pet owners to stay proactive in managing their pets’ health.

Evolving Healthcare Landscape

As veterinary medicine continues to advance, so do the available treatment options for pets. Cutting-edge procedures and technologies are now accessible to address various health issues in animals. Embracing pet insurance allows pet owners to take advantage of these advancements without facing insurmountable financial barriers.

Considerations Before Choosing Pet Insurance

While the benefits of pet insurance are evident, it’s essential for pet owners to carefully consider various factors before selecting a policy.

Pre-Existing Conditions

Many pet insurance policies do not cover pre-existing conditions. It’s crucial to understand what constitutes a pre-existing condition and how it may impact coverage. Some policies may exclude specific conditions permanently, while others may provide coverage after a waiting period.

Deductibles and Reimbursement

Understanding the deductible and reimbursement structure of a pet insurance policy is crucial. The deductible is the amount the pet owner must pay before the insurance coverage kicks in. Reimbursement percentages vary, and pet owners should be aware of how much they will be reimbursed for veterinary expenses.

Breed-Specific Considerations

Certain breeds may be prone to specific health issues, and pet owners should consider these factors when selecting insurance. Some policies may provide better coverage for breeds with known health risks.

Age of the Pet

The age of the pet can impact both eligibility and premium costs. While younger pets may qualify for lower premiums, older pets may face higher costs or limited coverage options.

Conclusion: A Commitment to Responsible Pet Ownership

Embracing pet insurance is a testament to the commitment of responsible pet ownership. It goes beyond providing food, shelter, and love; it involves safeguarding the health and well-being of our furry friends. As the understanding of pets’ emotional and physical needs deepens, pet insurance emerges as a crucial component of ensuring a fulfilling and healthy life for our animal companions.

Pet owners are encouraged to research, compare, and select insurance policies that align with their pets’ unique requirements. In doing so, they not only secure financial peace of mind but also contribute to a future where pets can enjoy longer, healthier lives. Ultimately, embracing pet insurance is a proactive step towards fostering a stronger and more enduring bond between humans and their beloved animal companions.

One Comment on “Embracing Pet Insurance: Guide to Securing Your Furry Friend’s Well-Being”