Introduction:

When embarking on the journey of borrowing money, whether it’s for a home, a car, or a personal project, understanding the intricacies of the financial commitment is paramount. One tool that proves invaluable in this regard is the loan amortization schedule. In this comprehensive guide, we will explore the concept of loan amortization schedules, unraveling their significance, components, and the insights they provide for borrowers.

Understanding Loan Amortization:

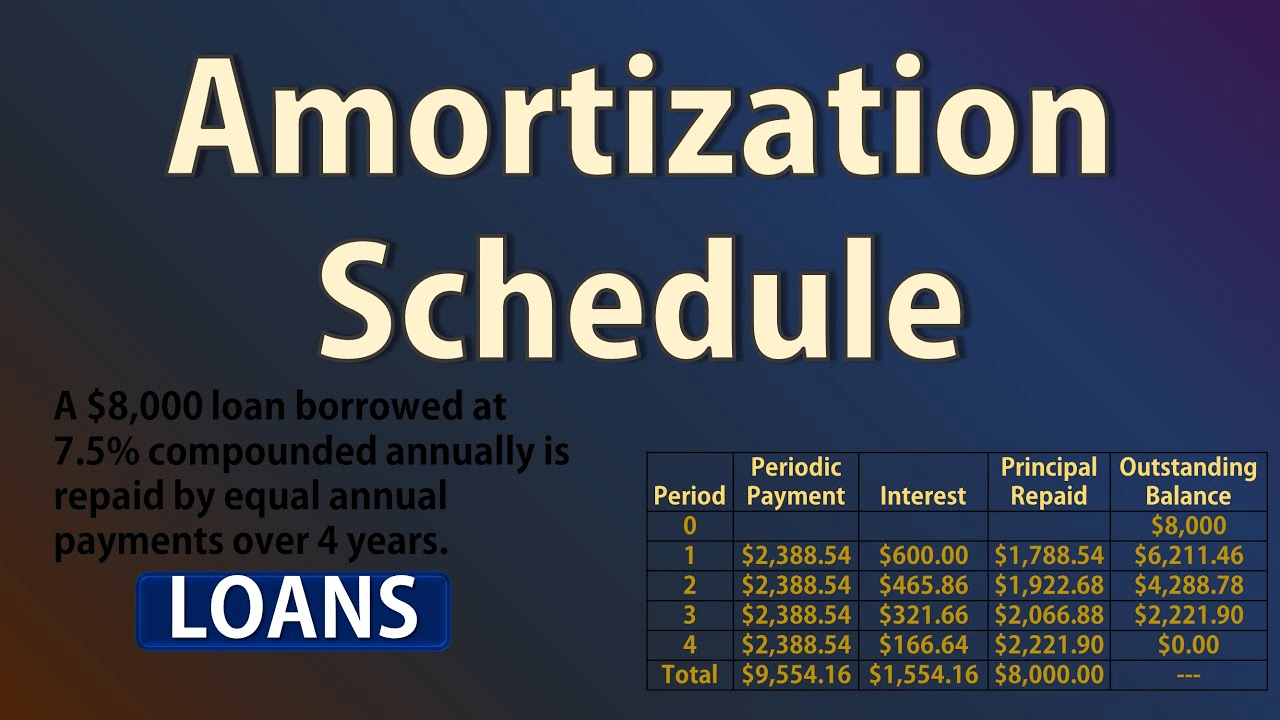

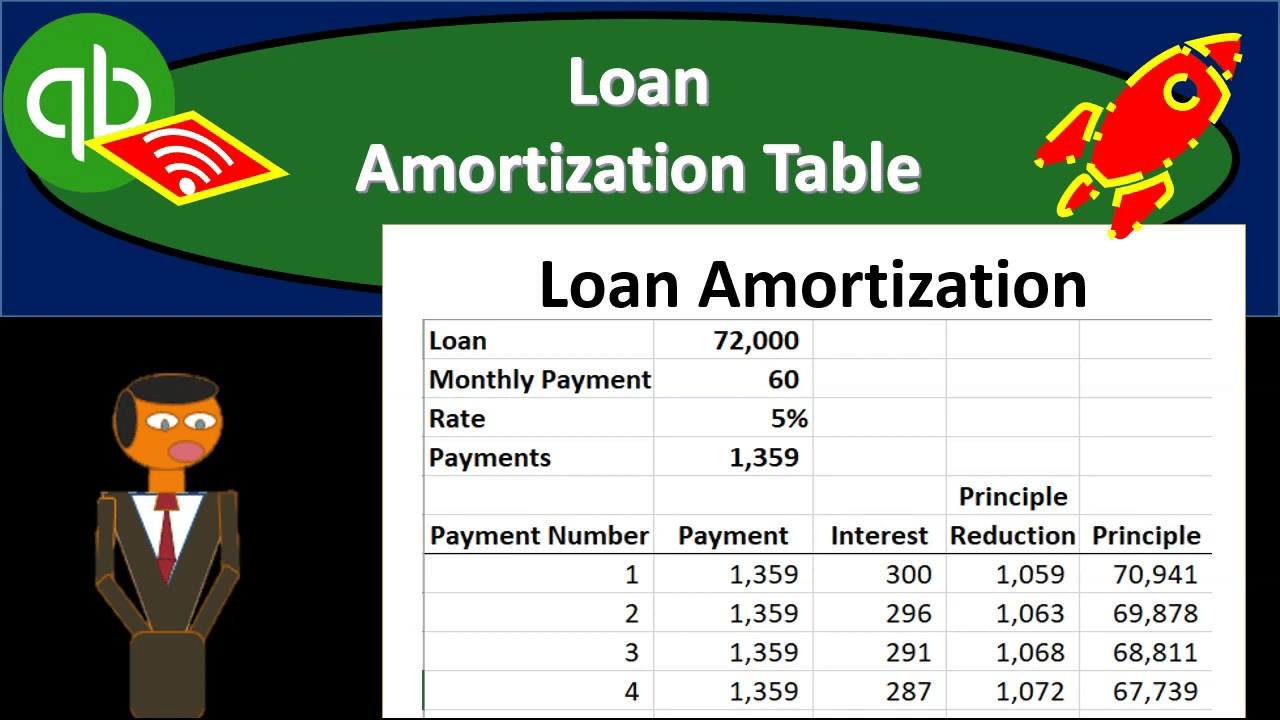

Loan amortization is the process of gradually paying off a debt through regular payments, which are typically a combination of principal and interest. A loan amortization schedule is a detailed table that outlines these payments over the life of the loan. It breaks down each payment, indicating the portion allocated to interest and the amount applied to reduce the principal balance.

Components of a Loan Amortization Schedule:

- Loan Amount: The principal amount borrowed is the foundation of the loan amortization schedule. It represents the initial sum that the borrower receives from the lender.

- Interest Rate: The interest rate, expressed as a percentage, determines the cost of borrowing.

- Loan Term: The loan term specifies the duration over which the borrower agrees to repay the loan. Common terms include 15, 20, or 30 years for mortgages and varying periods for other types of loans.

- Monthly Payment: The monthly payment is the fixed amount that the borrower pays each month. It includes both principal and interest, ensuring the loan is repaid over the agreed-upon term.

- Principal Repayment: The portion of the monthly payment allocated to principal repayment directly reduces the outstanding loan balance.

- Interest Payment: The interest payment is the amount attributed to the cost of borrowing and is calculated based on the remaining balance.

- Remaining Balance: The remaining balance represents the outstanding amount yet to be repaid. It decreases with each monthly payment as the borrower steadily reduces the principal.

Significance of Loan Amortization Schedules:

- Clarity in Repayment Structure: A loan amortization schedule provides borrowers with a clear and organized breakdown of their repayment structure.

- Budgeting and Financial Planning: Knowing the exact amount of each monthly payment allows borrowers to budget effectively and plan their finances. This insight is particularly crucial for individuals with fixed incomes, helping them manage their cash flow and allocate resources wisely.

- Early Repayment Considerations: For borrowers considering early repayment or making additional payments, the amortization schedule serves as a guide. It illustrates how extra payments can impact the overall interest paid and expedite the loan payoff.

- Interest vs. Principal Understanding: Over the life of a loan, the proportion of each payment allocated to interest and principal changes. Initially, interest payments dominate, but as the loan progresses, a larger portion is applied to principal. The amortization schedule illuminates this shift.

- Comparison of Loan Offers: When evaluating different loan offers, borrowers can use amortization schedules to compare the total cost of borrowing, monthly payments, and the impact of interest rates. This aids in making informed decisions about the most suitable loan.

Utilizing Loan Amortization Schedules:

- Online Amortization Calculators: Numerous online tools and calculators are available to generate loan amortization schedules. Borrowers can input their loan details, including the loan amount, interest rate, and term, to receive a detailed schedule instantly.

- Reviewing Regularly: It’s beneficial for borrowers to regularly review their loan amortization schedule, especially if they encounter changes in their financial situation. This ongoing assessment can help borrowers make informed decisions about refinancing, early repayment, or adjusting their budget.

- Early Repayment Strategies: For those considering early repayment, the amortization schedule acts as a strategic tool.

Conclusion:

Loan amortization schedules are invaluable tools that empower borrowers with insights into their repayment journey. By breaking down each payment and illustrating the interplay between principal and interest, these schedules provide transparency and aid in informed decision-making. Whether it’s navigating the complexities of a mortgage or managing the repayment of a personal loan, understanding and utilizing

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.