Introduction

Traveling to the United States, with its diverse landscapes, iconic cities, and vibrant culture, is a dream for many. As you plan your journey, one crucial aspect to consider is travel insurance. Understanding the costs associated with travel insurance for the USA is vital for ensuring a worry-free and secure trip. In this comprehensive guide, we’ll delve into the factors influencing the cost of travel insurance, the types of coverage available, and tips to help you make an informed decision.

Factors Influencing the Cost of Travel Insurance

- Trip Duration: The length of your stay in the USA plays a significant role in determining the cost of travel insurance. Longer trips generally incur higher premiums due to the extended coverage period.

- Age of the Traveler: Age is a critical factor affecting travel insurance costs. Generally, older travelers are quoted higher premiums as they may be considered at a higher risk for health-related issues.

- Coverage Limits: The cost is directly related to the level of coverage you select. Higher coverage limits for medical expenses, trip cancellations, and baggage loss will result in increased premiums.

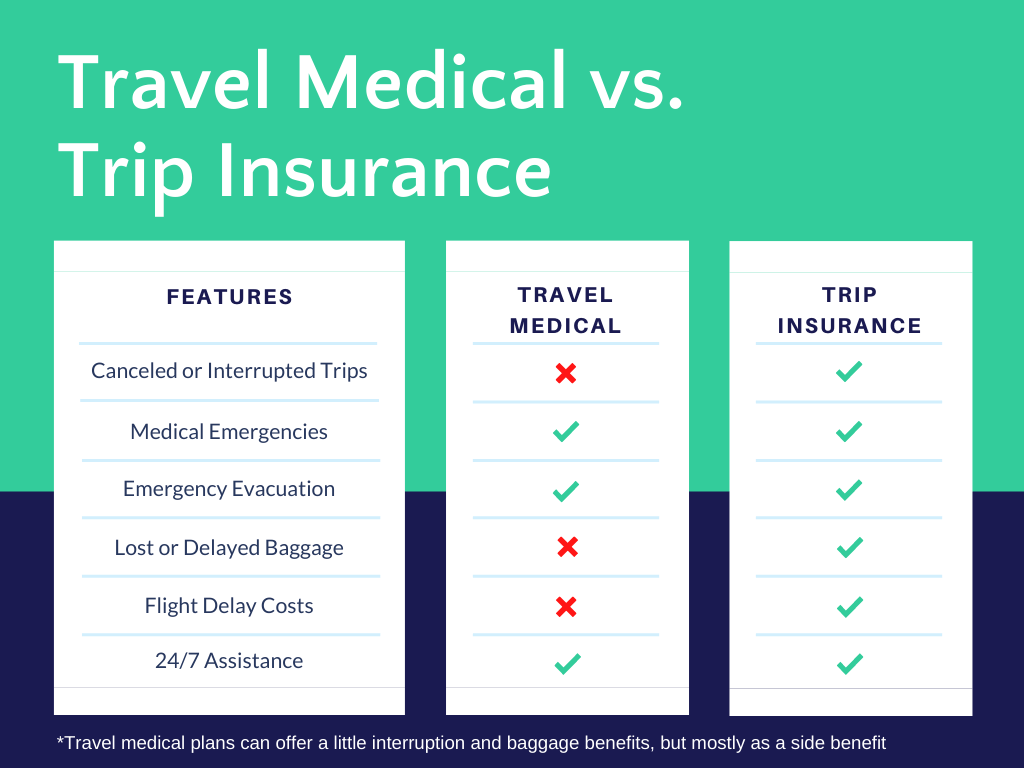

- Type of Coverage: Travel insurance comes in various forms, including basic coverage for medical emergencies, trip cancellation/interruption, and comprehensive coverage that combines various protections. Cost increases correspond with increased coverage levels.

- Pre-Existing Conditions: If you have pre-existing medical conditions, you may need additional coverage. However, this can raise the cost of your travel insurance, as insurers consider these conditions as potential risks.

- Travel Destination: The destination, in this case, the USA, also influences the cost. Factors such as the country’s healthcare costs, risk of natural disasters, and overall safety contribute to the premium.

- Travel Activities: Engaging in adventurous activities or sports during your trip may require additional coverage, impacting the overall cost of your travel insurance.

- Deductibles and Copayments: Opting for higher deductibles or copayments can reduce your premium but may result in increased out-of-pocket expenses in the event of a claim.

Types of Travel Insurance Coverage

- Medical Coverage: This covers medical expenses resulting from illness or injury during your trip, including hospital stays, doctor visits, and medication.

- Trip Cancellation/Interruption: This provides reimbursement for non-refundable trip expenses if your journey is canceled or interrupted due to covered reasons, such as illness, death, or severe weather.

- Baggage and Personal Belongings: Coverage for lost, stolen, or damaged baggage and personal items during your travels.

- Emergency Evacuation: This covers the cost of evacuation to the nearest adequate medical facility in the event of a medical emergency.

- Travel Delay: Reimburses additional expenses incurred due to unexpected travel delays, such as accommodation and meals.

- Accidental Death and Dismemberment: Provides a benefit in the event of accidental death or serious injury during your trip.

Average Costs of Travel Insurance for the USA

- Basic Coverage: Basic travel insurance coverage for a one-week trip to the USA can range from $20 to $100, depending on factors like age, trip duration, and coverage limits.

- Comprehensive Coverage: For comprehensive coverage with higher limits and additional protections, you may expect to pay between $50 and $200 for a one-week trip.

- Extended Stays: Longer stays, such as a month or more, can significantly increase the cost, potentially ranging from $100 to $500 or more, depending on factors like age and coverage limits.

- Senior Travelers: Travel insurance for older individuals may cost more, with premiums for seniors ranging from $50 to $300 or more, depending on the coverage.

- Family Coverage: If traveling with family, the cost of travel insurance can vary based on the number of family members and their ages. Family coverage for a week-long trip may range from $100 to $500 or more.

Tips for Getting Affordable Travel Insurance

- Compare Quotes: Shop around and obtain quotes from multiple insurance providers to find the most competitive rates for the coverage you need.

- Choose Wisely: Select coverage based on your specific needs. Avoid over-insuring by choosing only the protections necessary for your trip.

- Consider Annual Policies: If you’re a frequent traveler, an annual travel insurance policy might be more cost-effective than purchasing coverage for each trip individually.

- Review Policy Exclusions: Carefully read the policy exclusions to understand what is and isn’t covered. This helps avoid surprises and ensures you have the necessary coverage.

- Bundle with Other Policies: Some insurance providers offer discounts if you bundle travel insurance with other policies like home or auto insurance.

- Check Through Credit Cards: As a perk, several credit cards offer their users travel insurance. Review your credit card perks to determine if you already have coverage.

- Book in Advance: Get travel insurance as soon as you make your travel arrangements.

One Comment on “Costs of Travel Insurance for the USA Guide”