Introduction:

Insurance plays a pivotal role in the financial security and well-being of individuals and businesses in the United States. With a vast array of insurance products and a complex regulatory environment, Complex Landscape of Insurance in the USA understanding the intricacies of insurance in the USA is essential for making informed decisions. This article explores the key aspects of insurance in the USA, covering types of insurance, regulatory framework, market trends, and the evolving landscape of insurance in the country.

Types of Insurance:

The insurance industry in the USA is diverse, offering a wide range of products to meet the varying needs of consumers. Some of the prominent types of insurance include:

1. Health Insurance:

Health insurance is a critical component of the American insurance landscape, providing coverage for medical expenses. The Affordable Care Act (ACA) has significantly impacted the health insurance market, expanding coverage and introducing regulations to protect consumers.

2. Auto Insurance:

Auto insurance is mandatory in most states, covering damages and liabilities arising from car accidents. Policies may include coverage for property damage, bodily injury, and uninsured motorists.

3. Homeowners Insurance:

Homeowners insurance protects individuals from financial losses related to damage or loss of their homes. It typically covers structural damage, personal property, and liability for accidents on the property.

4. Life Insurance:

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It comes in various forms, such as term life, whole life, and universal life insurance.

5. Property and Casualty Insurance:

This category includes insurance for businesses and individuals against property damage and liability risks. It encompasses a broad range of policies, from commercial property insurance to liability coverage.

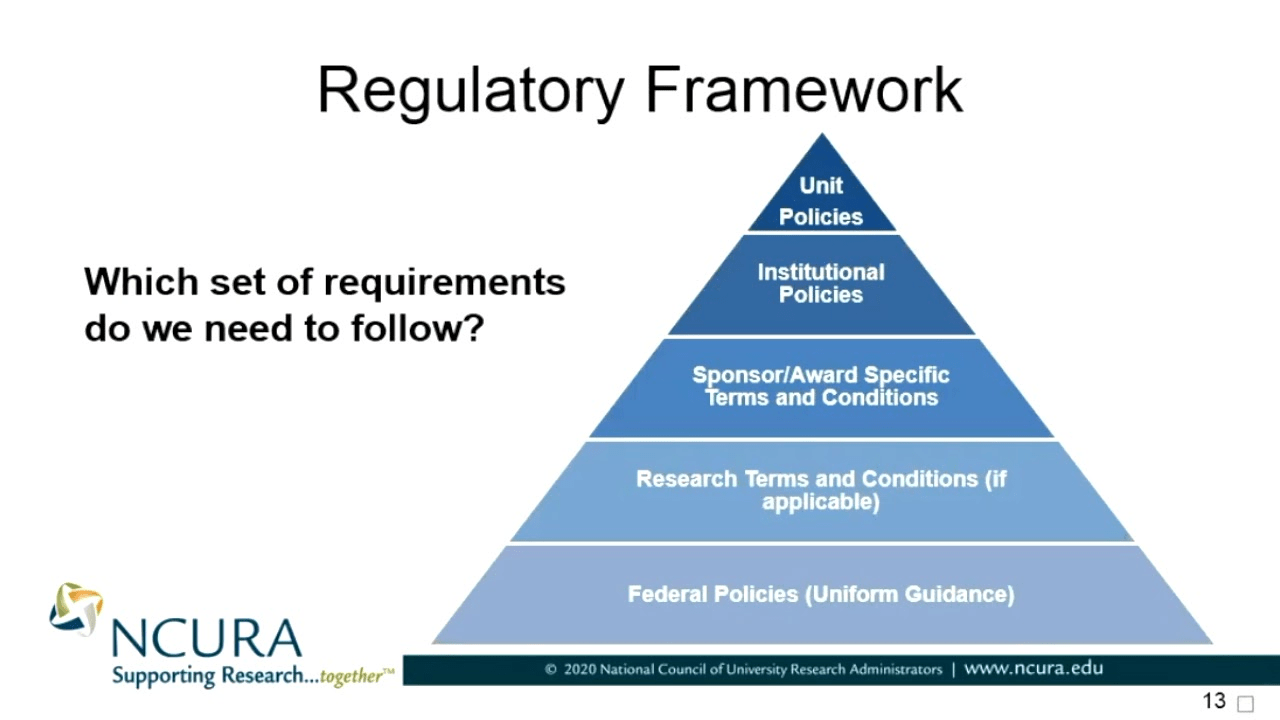

Regulatory Framework:

Insurance in the USA is regulated at both the federal and state levels. The National Association of Insurance Commissioners (NAIC) plays a crucial role in coordinating regulatory efforts among the states. Each state has its own insurance department responsible for overseeing insurance activities within its borders.

The regulatory framework aims to ensure the solvency of insurance companies, protect consumers, and maintain fair competition in the marketplace. States regulate insurance rates, policy forms, and market conduct to safeguard the interests of policyholders. The federal government’s involvement is primarily through the oversight of certain aspects, such as the Employee Retirement Income Security Act (ERISA), which governs employer-sponsored health and pension plans.

Market Trends:

The insurance industry in the USA is dynamic, with several trends shaping its evolution:

1. Technology Integration:

Insurtech, the integration of technology into insurance processes, has gained momentum. From online policy purchases to advanced data analytics for risk assessment, technology is transforming how insurers operate and interact with customers.

2. Shifts in Health Insurance Landscape:

The landscape of health insurance continues to evolve, with ongoing discussions about healthcare reform, the expansion of Medicaid, and the impact of demographic changes on insurance needs.

3. Climate Change and Insurance:

The increasing frequency and severity of natural disasters have raised concerns about the sustainability of insurance models. Insurers are reevaluating risk models and exploring innovative solutions to address the challenges posed by climate change.

4. Cybersecurity Insurance:

With the rising threat of cyber-attacks, cybersecurity insurance has become a crucial consideration for businesses. Insurers are developing policies to cover losses related to data breaches and other cyber threats.

Evolving Landscape:

The insurance landscape in the USA is continuously evolving, driven by external factors, regulatory changes, and consumer demands. Some notable developments include:

1. Telehealth and Health Insurance:

The growth of telehealth services has prompted a reevaluation of health insurance models. Insurers are adapting to the changing healthcare landscape by incorporating telehealth coverage into their policies.

2. Pandemic Impact on Insurance:

The COVID-19 pandemic has brought unprecedented challenges to the insurance industry. Insurers are navigating claims related to business interruption, event cancellations, and health coverage for pandemic-related expenses.

3. Digital Transformation:

Insurers are embracing digital transformation to enhance customer experiences, streamline processes, and improve operational efficiency. From online claims processing to digital policy management, technology is reshaping the way insurance services are delivered.

Conclusion:

Insurance in the USA is a multifaceted industry that plays a crucial role in providing financial protection and stability. Understanding the diverse types of insurance, the regulatory framework, and emerging trends is essential for individuals and businesses alike. As the insurance landscape continues to evolve, staying informed about these changes empowers consumers to make informed decisions and ensures the industry remains resilient in the face of emerging challenges.

Discover the Best Online Casinos for Cash Action

best casino games slots top casino slot sites.