Introduction

Borrowing money is a fundamental aspect of financial management for individuals, businesses, and even countries. The United States, despite being one of the world’s largest economies, engages in borrowing for various reasons. This article delves into the intricacies of why the U.S. needs to borrow money, exploring the underlying factors, implications, and the role of borrowing in sustaining economic growth.

The Purpose of Government Borrowing

1. Funding Public Expenditures:

- Infrastructure, Defense, and Social Programs: One primary reason the U.S. government borrows money is to fund public expenditures. This includes investments in infrastructure, national defense, and social programs such as healthcare and education. Borrowing allows the government to finance projects that contribute to the well-being and growth of the nation.

2. Budget Deficits:

- Balancing Revenue and Expenditure: When the government’s expenditures exceed its revenue, a budget deficit occurs. Borrowing helps bridge this gap, preventing disruptions to essential services and maintaining government operations. This is particularly crucial during economic downturns when tax revenues may decrease.

Economic Stabilization and Fiscal Policy

1. Countercyclical Measures:

- Addressing Economic Downturns: During recessions or economic downturns, government borrowing is a tool used to implement countercyclical measures. By injecting funds into the economy through increased spending, the government aims to stimulate economic activity, create jobs, and mitigate the impact of the downturn.

2. Monetary Policy Coordination:

- Collaboration with the Federal Reserve: The U.S. government works in coordination with the Federal Reserve to manage monetary policy. Borrowing allows the government to influence interest rates indirectly, promoting economic stability and controlling inflation.

Debt Financing vs. Revenue Generation

1. Optimal Debt Levels:

- Balancing Act: Maintaining a certain level of national debt is considered normal and, in some cases, optimal for economic growth. Responsible borrowing can contribute to investments that yield positive returns, making it a strategic financial decision.

2. Avoiding Overreliance on Taxation:

- Balancing Revenue Streams: Relying solely on taxation to fund government expenditures could stifle economic growth and burden taxpayers. Borrowing provides an alternative source of funds, distributing the financial load over time and avoiding immediate strain on citizens.

Global Economic Considerations

1. International Trade and Relations:

- Maintaining Economic Influence: Borrowing allows the U.S. to maintain its economic influence on the global stage. It can participate in international trade, provide aid to other nations, and contribute to global economic stability.

2. Dollar as a Global Reserve Currency:

- U.S. Dollar Dominance: The U.S. dollar’s status as a global reserve currency gives the country a unique advantage. Borrowing in its own currency allows the U.S. to have more control over its monetary policy and interest rates.

Implications and Challenges of Borrowing

1. Accumulation of National Debt:

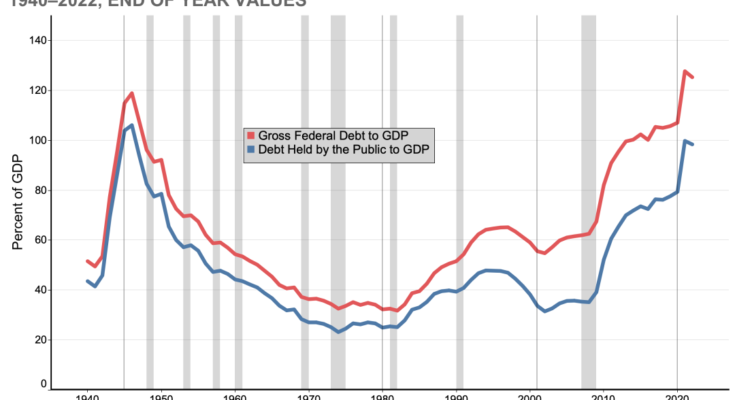

- Long-Term Consequences: Continuous borrowing contributes to the accumulation of national debt. While manageable levels of debt can be sustainable, excessive debt may pose challenges, affecting future generations and limiting the government’s fiscal flexibility.

2. Interest Payments:

- Burden on Future Budgets: Servicing the interest on the national debt requires a significant portion of the annual budget. As the debt grows, so do interest payments, potentially limiting funds available for essential services and future investments.

3. Creditworthiness and Ratings:

- Impact on Financial Standing: The U.S. government’s ability to borrow at favorable terms is influenced by its creditworthiness. High levels of debt relative to the country’s economic output can lead to credit rating downgrades, affecting borrowing costs.

The Role of Fiscal Responsibility

1. Balancing Fiscal Policies:

- Sustainable Budgeting: Striking a balance between fiscal policies is essential. Responsible borrowing, combined with effective revenue generation and expenditure management, contributes to sustainable budgeting practices.

2. Long-Term Planning:

- Mitigating Future Challenges: Government borrowing should be accompanied by long-term planning. Investments in education, innovation, and infrastructure can lead to economic growth, helping to offset the challenges posed by a growing national debt.

Conclusion

The need for the U.S. to borrow money is deeply rooted in the complexities of managing a modern economy. From funding essential public services to navigating economic downturns, borrowing serves as a tool for the government to fulfill its obligations and sustain growth. However, it comes with implications and challenges that necessitate a delicate balance between fiscal responsibility and addressing the nation’s evolving needs. Understanding the dynamics of why the U.S. borrows money provides insight into the intricate relationship between government finance, economic stability, and the well-being of the nation.

One Comment on “Borrowing in the United States Necessity and Implications”