Introduction

Moving to a new country can be an exciting adventure, but it also comes with its fair share of challenges. For foreigners relocating to the United States, one crucial aspect to consider is auto insurance. Understanding the intricacies of the American auto insurance system is essential to ensure that you are adequately covered and compliant with the law. In this comprehensive guide, we will explore the nuances of auto insurance for foreigners in the USA.

Understanding the Basics

Auto insurance is mandatory in the United States, and each state has its own set of rules and regulations governing coverage requirements. The primary purpose of auto insurance is to provide financial protection in the event of an accident, theft, or other covered incidents. As a foreigner, it’s crucial to familiarise yourself with the basic types of coverage available:

1. Liability Coverage

This is the most basic form of auto insurance and covers injuries and property damage that you may cause to others in an accident.

2. Collision Coverage

This type of coverage pays for the repairs to your vehicle in the event of a collision, regardless of fault.

3. Comprehensive Coverage

This coverage protects your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.

4. Uninsured/Under insured Motorist Coverage

This coverage steps in if you are involved in an accident with a driver who either has no insurance or insufficient coverage.

Insurance Requirements for Foreigners

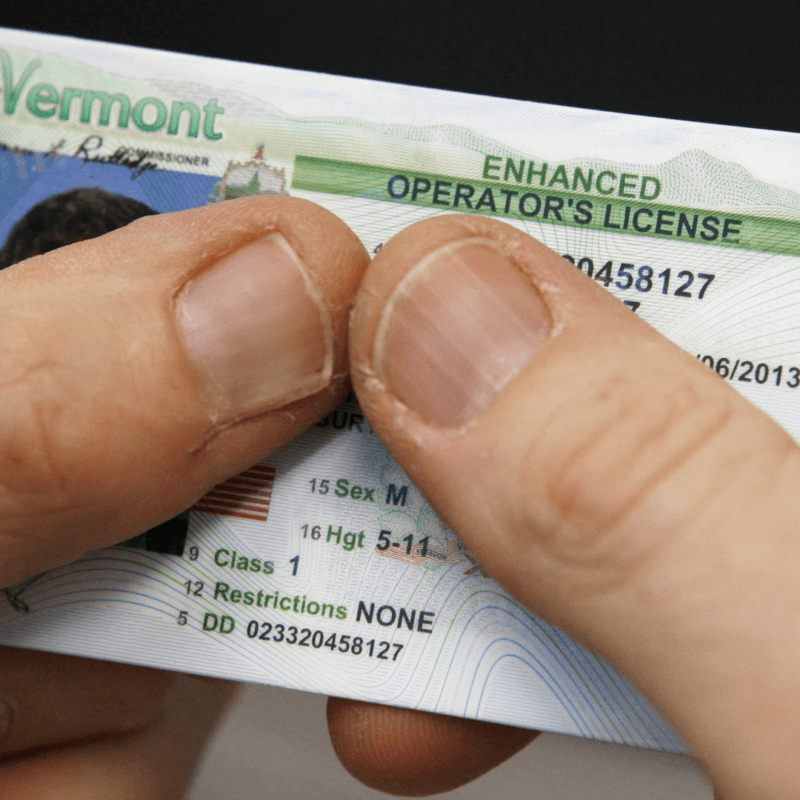

Foreigners residing in the USA may encounter unique challenges when obtaining auto insurance. One common requirement is a valid driver’s license. Most insurers accept foreign licenses, but it’s essential to check whether your license is recognized in the state you’re residing in.

Additionally, some insurers may ask for an International Driving Permit (DIP) in conjunction with your foreign license. An DIP serves as a translation of your license and provides additional verification for authorities.

Insurance premiums for foreigners can vary based on factors such as driving history, the type of vehicle, and coverage preferences. It’s advisable to shop around and obtain quotes from multiple insurers to ensure you get the best rates.

Special Considerations for Expatriates

Expatriates, or individuals temporarily residing in the USA for work or other reasons, may face additional considerations when it comes to auto insurance. Some insurers offer specialised policies tailored to expatriates, taking into account their unique circumstances and potential travel requirements.

Expatriates should also be aware of the duration of their stay, as it can impact the type of coverage needed. Short-term visitors may opt for temporary auto insurance, while those with longer stays might consider a standard policy.

Navigating State-Specific Regulations

The United States consists of 50 states, each with its own set of auto insurance regulations. As a foreigner, it’s crucial to understand the specific requirements of the state you’re residing in. Some states have no-fault insurance systems, while others follow a traditional tort system. Knowing the regulations in your state will help you select the appropriate coverage and understand how claims are handled.

Researching Insurance Companies

Choosing the right insurance provider is a critical step in securing the best coverage for your needs. Conduct thorough research on various insurance companies, considering factors such as customer reviews, financial stability, and the range of coverage options offered. Some well-known national insurers may cater specifically to international drivers, simplifying the process for foreigners.

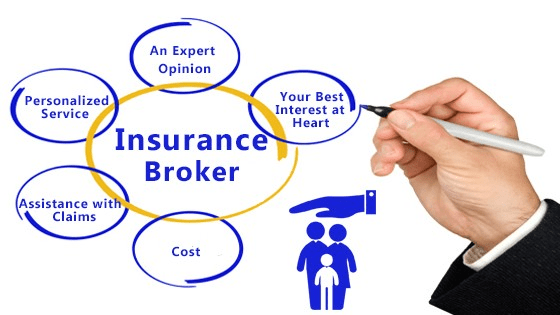

Utilizing Insurance Brokers

For foreigners unfamiliar with the intricacies of the American insurance market, working with an insurance broker can be advantageous. Insurance brokers are knowledgeable professionals who can help you navigate the complexities of auto insurance, identify suitable policies, and obtain the best rates. They can also provide guidance on meeting specific state requirements and help you understand the fine print of insurance policies.

Common Challenges Faced by Foreigners

While obtaining auto insurance in the USA is generally straightforward for foreigners, there are some common challenges they may face:

1. Lack of U.S. Driving History

Many insurance companies use your driving history to assess risk and determine premiums. As a newcomer, you may not have a U.S. driving record, which could affect your insurance rates. Some insurers may consider your international driving history to partially mitigate this challenge.

2. Limited Credit History

In the U.S., credit history often plays a role in determining insurance rates. Foreigners may have limited or no U.S. credit history, making it essential to find insurers that are more lenient in their credit assessments.

3. Language Barriers

Understanding insurance terminology and policies can be challenging, especially for those not fluent in English. It’s crucial to seek assistance from bilingual agents or use translation services to ensure you fully comprehend the terms and conditions of your policy.

Conclusion

Navigating auto insurance for foreigners in the USA requires careful consideration of various factors, from understanding state-specific regulations to choosing the right coverage options. While challenges may arise, with proper research and guidance, obtaining suitable auto insurance can be a manageable and essential aspect of settling into life in the United States. By familiarising yourself with the basics, exploring insurance options, and seeking professional advice when needed, you can ensure that you are adequately protected on the American roads.