Introduction:

A Comprehensive Overview of Max Life Insurance In the ever-changing landscape of personal finance, the need for a robust and reliable life insurance plan cannot be overstated. One prominent player in the insurance sector that has garnered attention for its commitment to providing financial security is Max Life Insurance. In this comprehensive guide, we will delve into the intricacies of Max Life Insurance, exploring its history, offerings, customer-centric approach, and the factors that make it a significant player in the insurance industry.

A Brief History of Max Life Insurance:

A Comprehensive Overview of Max Life Insurance Established in 2000, Max Life Insurance has steadily grown to become one of the leading life insurance providers in India. The company is a joint venture between Max Financial Services Ltd. and Mitsui Sumitomo Insurance Co. Ltd., bringing together the expertise of a homegrown financial giant and the global strength of a Japanese insurance leader. This partnership has enabled Max Life Insurance to combine international best practices with a deep understanding of the Indian market.

Max Life Insurance is known for its customer-centric approach, innovative product offerings, and a commitment to financial well-being.

Key Offerings:

- Term Insurance Plans: Max Life Insurance offers comprehensive term insurance plans designed to provide financial protection to the policyholder’s family in the unfortunate event of the policyholder’s demise. These plans often come with options for coverage up to a specified age, ensuring long-term security.

- Savings and Investment Plans: For individuals looking to grow their wealth while ensuring life coverage, Max Life Insurance offers a range of savings and investment plans. These plans combine life insurance coverage with opportunities for wealth creation, catering to the diverse financial goals of policyholders.

- Child Plans: Recognizing the importance of securing a child’s future, Max Life Insurance provides specialized child plans.

- Retirement Plans: In an era where retirement planning is crucial, Max Life Insurance offers retirement plans to help individuals build a corpus that can sustain them during their golden years. These plans provide a regular income stream after retirement, ensuring financial independence.

- Rural and Group Insurance: Understanding the unique needs of diverse segments of society, Max Life Insurance has tailored offerings for rural and group insurance.

Customer-Centric Approach:

- Transparent Communication: Max Life Insurance prioritizes transparent communication with its customers. The company is committed to ensuring that policyholders fully understand the terms and conditions of their insurance plans. This transparency fosters trust and helps customers make informed decisions.

- Digital Initiatives: Embracing the digital age, Max Life Insurance has implemented various digital initiatives to enhance customer experience.

- Customer Support: Recognizing the importance of responsive customer support, Max Life Insurance has established robust customer service channels.

- Innovative Products: Max Life Insurance continually strives to develop innovative insurance products that cater to the evolving needs of customers.

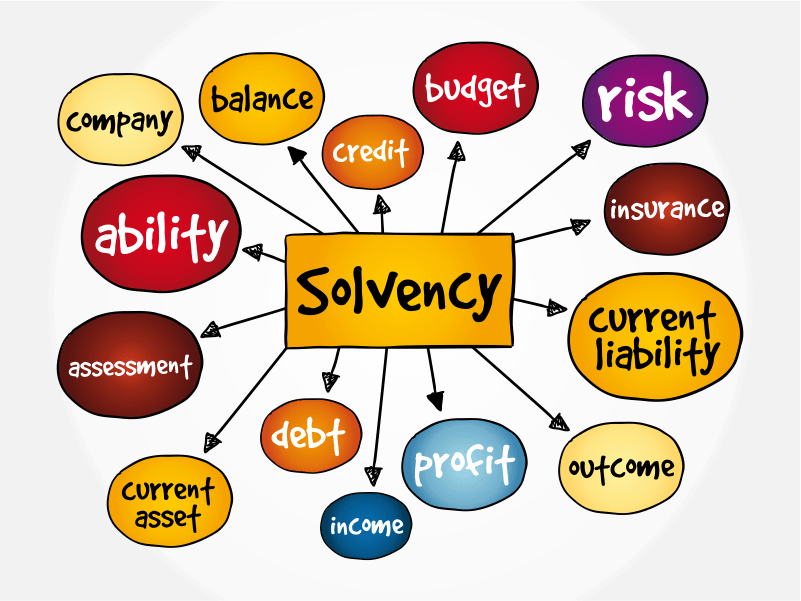

Financial Strength and Solvency:

Max Life Insurance boasts a strong financial foundation, reflecting its ability to meet its financial obligations to policyholders.

Community Engagement and Corporate Social Responsibility:

Beyond its role as an insurance provider, Max Life Insurance actively engages in corporate social responsibility (CSR) initiatives.

Conclusion:

Max Life Insurance stands as a testament to the commitment of combining financial security with customer-centric values. Its emphasis on transparency, innovative solutions, and ethical business practices has earned it the trust of a vast customer base.

One Comment on “A Comprehensive Overview of Max Life Insurance”