Introduction:

In a landscape where uncertainties are an inevitable part of life, having insurance is a prudent choice. However, the quest for financial protection often comes with the desire to find affordable options. This article serves as a comprehensive guide for those seeking cheap insurance in the USA, exploring strategies, considerations, and prominent avenues to navigate the complex world of insurance while keeping costs in check.

Understanding the Importance of Insurance:

A Shield Against the Unknown:

Insurance serves as a financial safety net, offering protection against unforeseen events that could otherwise lead to significant financial strain. Whether it’s health insurance, auto insurance, home insurance, or other forms of coverage, the peace of mind that comes with being insured is invaluable.

However, the cost of insurance can vary widely, and finding affordable options becomes crucial for individuals and families looking to manage their budgets effectively. This guide aims to provide insights into the strategies and considerations that can help in the quest for cheap insurance in the USA.

Strategies for Finding Cheap Insurance:

1. Shop Around:

- One of the fundamental strategies to find cheap insurance is to shop around. Different insurance providers may offer varying rates for similar coverage. Online comparison tools, insurance brokers, and direct inquiries to insurance companies can help in understanding the range of options available.

2. Bundle Policies:

- Many insurance companies offer discounts when you bundle multiple policies. Combining auto and home insurance or bundling renters and auto insurance, for example, can often result in significant savings. This approach not only provides convenience but also serves as a cost-effective strategy.

3. Raise Deductibles:

- Adjusting the deductible—the amount you pay out of pocket before insurance coverage kicks in—can impact your premium. Higher deductibles generally lead to lower premiums. However, it’s crucial to strike a balance that aligns with your financial comfort in case of a claim.

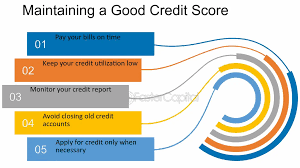

4. Maintain a Good Credit Score:

- In many cases, your credit score can influence your insurance premiums. Maintaining a good credit score demonstrates financial responsibility and can lead to lower rates. Regularly checking and improving your credit score can have a positive impact on insurance costs.

5. Consider Usage-Based Insurance:

- For auto insurance, consider opting for usage-based insurance programs. These programs monitor driving behavior through telematics devices, and if you’re a safe driver, you could be eligible for discounts based on your actual driving habits.

6. Explore Government Programs:

- Depending on your circumstances, you may qualify for government-sponsored insurance programs that offer affordable coverage. Programs like Medicaid, CHIP (Children’s Health Insurance Program), and government-subsidized health plans can provide financial relief.

Types of Cheap Insurance in the USA:

1. Affordable Health Insurance:

- Health insurance is a critical component of financial planning. The Affordable Care Act (ACA) has expanded access to affordable health insurance options, and individuals can explore the Health Insurance Marketplace to find coverage that fits their budget.

2. Cheap Auto Insurance:

- Auto insurance costs can vary based on factors such as driving history, location, and the type of coverage needed. Comparing quotes from multiple providers and taking advantage of discounts can help in securing affordable auto insurance.

3. Low-Cost Home Insurance:

- Protecting your home doesn’t have to break the bank. Exploring discounts, bundling policies, and implementing home safety measures can contribute to finding affordable home insurance options.

4. Budget-Friendly Renters Insurance:

- Renters insurance is often more affordable than homeowners insurance. It provides coverage for personal belongings and liability protection. Shopping around and customizing coverage to suit your needs can help in finding budget-friendly options.

5. Inexpensive Life Insurance:

- Life insurance is a crucial financial planning tool. Term life insurance, in particular, tends to be more affordable than whole life insurance. Comparing quotes and assessing your coverage needs can aid in finding cost-effective life insurance solutions.

Government-Sponsored Programs for Cheap Insurance:

1. Medicaid:

- Medicaid is a state and federally-funded program that provides health coverage for low-income individuals and families. Eligibility is often determined by factors such as income, family size, and disability status.

2. CHIP (Children’s Health Insurance Program):

- CHIP provides low-cost health coverage for children in families that earn too much to qualify for Medicaid but may not have access to affordable private insurance. Eligibility varies by state.

3. Obamacare Subsidies:

- The Affordable Care Act provides subsidies to eligible individuals and families purchasing health insurance through the Health Insurance Marketplace. These subsidies can significantly reduce the cost of health insurance premiums.

Prominent Affordable Insurance Companies:

1. Geico:

- Geico is known for offering competitive rates on auto insurance. The company’s direct-to-consumer model and a variety of discounts make it a popular choice for those seeking affordable coverage.

2. Progressive:

- Progressive is recognized for its innovative approach to auto insurance, offering usage-based insurance programs like Snapshot. The company’s commitment to competitive pricing has made it a top choice for cost-conscious consumers.

3. Esurance:

- Esurance, an Allstate company, is an online-focused insurer that aims to provide affordable coverage. Its user-friendly platform and customizable policies make it a convenient option for those seeking budget-friendly insurance.

4. HealthCare.gov:

- The federal Health Insurance Marketplace, accessible through HealthCare.gov, offers a platform to explore and compare health insurance plans. Depending on your income, you may qualify for subsidies that make coverage more affordable.

Conclusion:

Finding cheap insurance in the USA is a quest for balance—balancing the need for adequate coverage to manage costs effectively. As individuals and families navigate the intricate landscape of insurance options, careful consideration of strategies, types of coverage, and available government programs can pave the way to financial security.

Remember that the cheapest insurance isn’t always the best, and it’s crucial to assess coverage adequacy, customer service, and the financial stability of the insurance provider. Ultimately, the pursuit of affordable insurance is a journey toward financial resilience, ensuring that protection against the unknown remains accessible to all.

Join the adventure at wild8.co.uk

ukgc casino https://wild8.co.uk/.