Introduction:

Starting a new business is an exciting venture, but it often requires significant financial investment. For many entrepreneurs in the UK, obtaining a loan is a crucial step towards turning their business idea into a reality. But getting through the loan application process can be difficult, particularly for new business owners. In this comprehensive guide, we’ll explore everything you need to know about securing a loan for your new business in the UK.

Understanding Your Financing Needs:

Before diving into the loan application process, it’s essential to have a clear understanding of your business’s financing needs. Take the time to assess your startup costs, operational expenses, and projected cash flow. This will help you determine how much funding you require and what type of loan would best suit your business.

Types of Loans Available:

In the UK, aspiring entrepreneurs have access to a variety of loan options tailored to meet the needs of new businesses. These include:

1. Start-Up Loans:

Designed specifically for new businesses, start-up loans offer relatively small amounts of funding to help cover initial expenses such as equipment purchases, marketing, and working capital.

2. Small Business Loans:

These loans are suitable for businesses that have been operating for a short time and need financing to support growth or expansion efforts.

3. Government-Backed Loans:

Programs such as the Enterprise Finance Guarantee (EFG) scheme provide government-backed guarantees to lenders, making it easier for new businesses to access funding.

4. Peer-to-Peer Lending:

Platforms like Funding Circle and RateSetter connect borrowers directly with individual investors willing to provide funding in exchange for interest payments.

5. Bank Loans:

Traditional bank loans remain a popular option for many entrepreneurs, offering competitive interest rates and flexible repayment terms.

Choosing the Right Lender:

Once you’ve determined the type of loan that best suits your needs, it’s time to find the right lender. Research various financial institutions, including banks, credit unions, online lenders, and alternative financing providers. Consider factors such as interest rates, repayment terms, eligibility criteria, and customer service reputation.

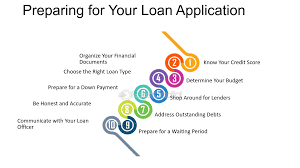

Preparing Your Loan Application:

Before approaching lenders, it’s crucial to prepare a comprehensive loan application package. This typically includes:

1. Business Plan:

A detailed business plan outlining your company’s mission, products or services, target market, competitive analysis, marketing strategy, and financial projections.

2. Financial Statements:

Up-to-date financial statements, including income statements, balance sheets, and cash flow forecasts, demonstrate your business’s financial health and ability to repay the loan.

3. Personal and Business Credit History:

Lenders will evaluate your personal and business credit history to assess your creditworthiness. Ensure your credit reports are accurate and up to date.

4. Collateral:

Lenders may require collateral to secure the finance, depending on the type of loan. This could include business assets, equipment, or personal assets such as real estate or vehicles.

5. Legal Documentation:

Legal documents such as business licenses, permits, contracts, and incorporation papers may be required as part of the loan application process.

Submitting Your Application:

Once you’ve compiled all necessary documentation, it’s time to submit your loan application to potential lenders. Be ready to respond to any inquiries they might have and, upon request, offer more details. Keep in mind that the approval process may take time, so be patient and proactive in following up with lenders.

Managing Your Loan:

If your loan application is approved, it’s essential to manage your debt responsibly to ensure the long-term success of your business. Make timely payments to avoid defaulting on the loan, which could negatively impact your credit rating and ability to secure future financing. Additionally, regularly monitor your business’s financial performance and adjust your budget as needed to accommodate loan repayments.

Conclusion:

Securing a loan for your new business in the UK can be a challenging but rewarding process. By understanding your financing needs, exploring the available loan options, choosing the right lender, preparing a comprehensive application, and managing your debt responsibly, you can position your business for growth and success. With determination, diligence, and strategic planning, you can unlock the funding needed to bring your entrepreneurial vision to life.