Introduction

In today’s dynamic economic landscape, securing a loan can be a vital step in achieving various financial goals. Whether it’s purchasing a home, starting a business, or covering unexpected expenses, understanding how to get a loan in the USA is crucial. This comprehensive guide will walk you through the key aspects of obtaining a loan, from understanding the types of loans available to navigating the application process.

Types of Loans in the USA

Before delving into the application process, it’s essential to have a clear understanding of the different types of loans available in the USA. The most common categories include:

- Personal Loans: These are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or medical expenses.

- Mortgages: Specifically designed for homebuyers, mortgages allow individuals to purchase a home by borrowing money from a lender, with the property serving as collateral.

- Auto Loans: Tailored for individuals looking to purchase a vehicle, auto loans provide the necessary funds with the vehicle itself serving as collateral.

- Student Loans: Geared towards financing education, these loans help cover tuition, books, and other educational expenses.

- Small Business Loans: Entrepreneurs seeking to start or expand their businesses can explore various loan options, including SBA loans, business lines of credit, and term loans.

Understanding Your Credit Score

One of the critical factors lenders consider when evaluating loan applications is the borrower’s credit score. Your credit score is a numerical representation of your creditworthiness and is based on factors such as payment history, credit utilization, length of credit history, and types of credit in use.

Before applying for a loan, it’s advisable to check your credit score and report. If your credit score is less than stellar, take steps to improve it by paying bills on time, reducing outstanding debt, and correcting any inaccuracies on your credit report.

Researching Lenders

Once you have a clear understanding of the type of loan you need and your creditworthiness, the next step is to research potential lenders. Banks, credit unions, online lenders, and peer-to-peer lending platforms are common sources of loans. Each has its own advantages and disadvantages, so it’s crucial to compare interest rates, fees, and terms to find the best fit for your financial situation.

Preparing Documentation

Common documents include proof of income, tax returns, employment verification, and information about existing debts and assets. Gather these documents in advance to streamline the application process and demonstrate your financial stability to potential lenders.

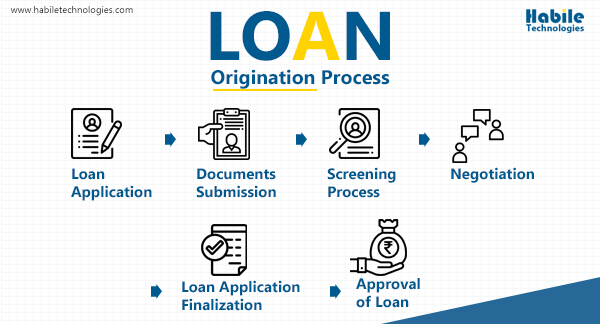

The Loan Application Process

Once you’ve selected a lender and compiled the necessary documentation, it’s time to start the application process. The steps involved can vary depending on the type of loan and the lender, but a general outline includes:

- Prequalification: Some lenders offer prequalification, allowing you to estimate how much you can borrow and at what interest rate. This step is non-binding and provides a preliminary assessment of your eligibility.

- Submit Application: Complete the formal loan application provided by the lender. This may be done online, in person, or over the phone, depending on the lender’s preferences.

- Underwriting: The lender will review your application and supporting documents to assess your creditworthiness and financial stability. This process may involve additional requests for information.

- Loan Approval: Upon successful underwriting, the lender will issue a loan approval, specifying the loan amount, interest rate, and terms. Take time to review the offer carefully before accepting.

- Closing: The final step involves signing the loan agreement and any additional documents required by the lender. For mortgages, this is known as the closing process.

Responsibly Managing Your Loan

Once you’ve obtained a loan, responsible management is crucial to maintaining your financial health. Follow these tips to ensure a positive loan experience:

- Budgeting: Incorporate loan repayments into your budget to ensure timely payments and avoid financial strain.

- Emergency Fund: Maintain an emergency fund to cover unexpected expenses and prevent reliance on additional loans.

- Communication with Lender: If you encounter financial difficulties, communicate with your lender promptly.

- Credit Monitoring: Keep an eye on your credit score and report regularly to ensure accuracy and identify any potential issues.

Conclusion

Securing a loan in the USA involves careful planning, research, and responsible financial management. By understanding the types of loans available, improving your creditworthiness, researching lenders, and navigating the application process thoughtfully, you can increase your chances of obtaining a loan that aligns with your financial goals. Remember, the key to a successful loan experience is staying informed, proactive, and financially disciplined throughout the entire process

2 Comments on “A Comprehensive Guide on How to Get a Loan in the USA”