Introduction:

Insurance is essential for protecting people, families, and companies from unanticipated dangers and monetary losses. In Canada, the insurance landscape is robust and diverse, offering a wide array of products tailored to various needs. In this comprehensive guide, we delve into what insurance is in Canada, its types, regulations, and key considerations.

What is Insurance?

Fundamentally, insurance is a contract that is made between an insurance firm (the insurer) and a person or entity (the insured).The insured pays a premium, typically on a regular basis, in exchange for financial protection against specific risks.

Types of Insurance in Canada:

- Auto Insurance: Mandatory in most provinces, auto insurance provides coverage for damages or injuries resulting from car accidents. It typically includes coverage for bodily injury liability, property damage liability, accident benefits, and uninsured/underinsured motorist coverage.

- Home Insurance: Home insurance protects homeowners against property damage, theft, and liability risks. It encompasses coverage for the dwelling, personal belongings, additional living expenses, and liability protection.

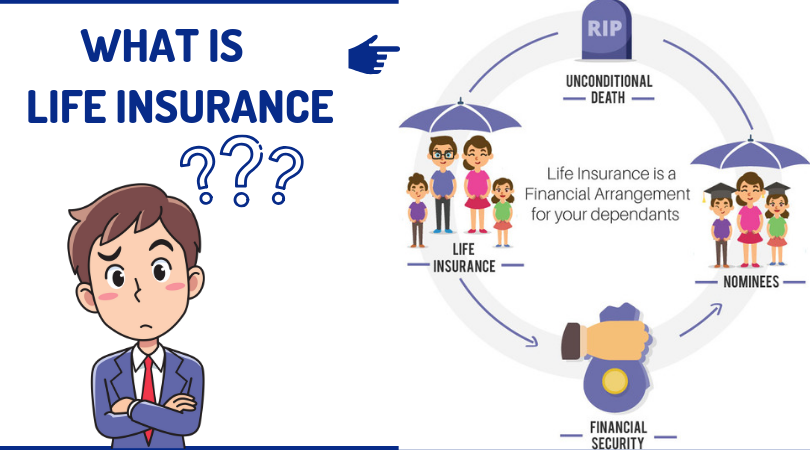

- Life Insurance: Life insurance offers financial protection to beneficiaries in the event of the insured’s death.

- Business Insurance: Business insurance protects businesses against various risks, including property damage, liability claims, business interruption, and employee-related risks.

Regulatory Framework:

The regulatory framework aims to ensure consumer protection, fair market practices, and financial stability within the insurance industry.

Key Considerations:

- Coverage Limits: Understanding the coverage limits and exclusions of an insurance policy is crucial to ensure adequate protection against potential risks.

- Policy Features: Assessing the features and optional riders offered within an insurance policy allows individuals to tailor coverage to their specific needs and preferences.

- Insurer Reputation: Researching the reputation, financial strength, and customer service track record of insurance companies helps individuals select reputable insurers with a history of fulfilling their obligations to policyholders.

Conclusion:

Insurance serves as a financial safety net, providing peace of mind and protection against life’s uncertainties. In Canada, a diverse range of insurance products and a robust regulatory framework offer individuals and businesses access to comprehensive coverage options.